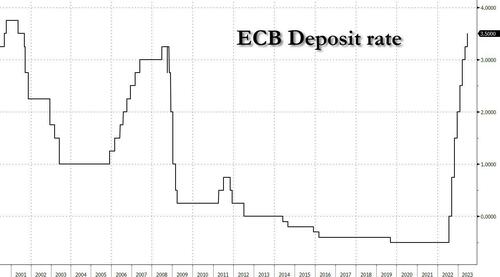

As expected, the central bank lifted the interest rate on the main refinancing operations to 4% from 3.75%, matching the consensus estimate. The deposit facility and marginal lending facility rates were also increased to 3.5% and 4.25%, respectively – the 8th hike in a row, and the highest since 2001.

Some more highlights from the ECB statement:

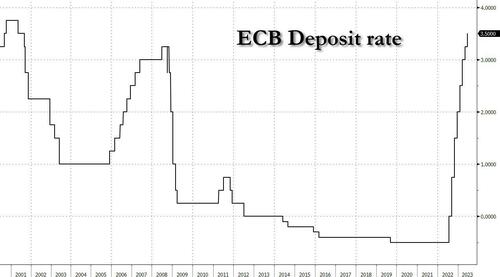

- Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It therefore today decided to raise the three key ECB interest rates by 25 basis points.

- Reflects the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation, and the strength of monetary policy transmission.

- Indicators of underlying price pressures remain strong, although some show tentative signs of softening. Staff have revised up their projections for inflation excluding energy and food, especially for this year and next year, owing to past upward surprises and the implications of the robust labour market for the speed of disinflation.

- Governing Council’s past rate increases are being transmitted forcefully to financing conditions and are gradually having an impact across the economy. Borrowing costs have increased steeply and growth in loans is slowing. Tighter financing conditions are a key reason why inflation is projected to decline further towards target, as they are expected to increasingly dampen demand.

Future

- Governing Council’s future decisions will ensure that the key ECB interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target and will be kept at those levels for as long as necessary.

- Will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction. In particular, its interest rate decisions will continue to be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

APP

- Confirms that it will discontinue the reinvestments under the asset purchase program as of July 2023.

Here is a redline comparison of the two most recent ECB statements:

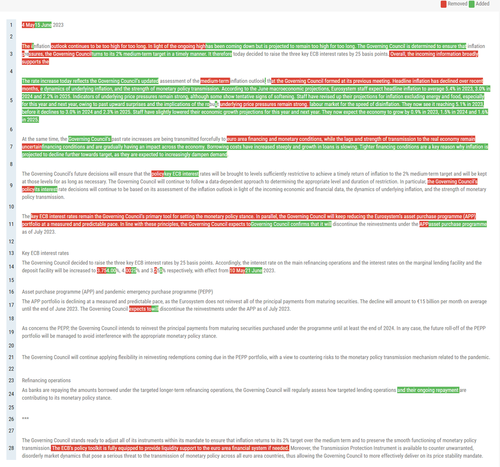

While the hike was as expected, what was not expected was the ECB’s latest warning that inflation is “projected to remain too high for too long” as the central bank surprised the dovish-hoping audience by also increasing their inflation forecasts:

- Core inflation seen at 5.1% in 2023 (prev. 4.6%), 3.0% in 2024 (prev. 2.5%) and 2.3% in 2025 (prev. 2.2%).

- Headline inflation to average 5.4% in 2023 (prev. 5.2%), 3.0% in 2024 (prev. 2.9%) and 2.2% in 2025 (prev. 2.1%).

- Expect the economy to grow 0.9% in 2023 (prev. 1.0%), 1.5% in 2024 (prev. 1.6%) and 1.6% in 2025 (prev. 1.6%).

As a reminder, again, the eurozone is currently in a technical recession.

The inflation ‘hike’ comes as hopes were rising that the trend of EU inflation was your friend (annual inflation in the euro area eased to 6.1% from 7% in April, while core inflation fell to 5.3% from 5.6%).

This is a clear signal that they will keep hiking…

“Future decisions will ensure that the key ECB interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target and will be kept at those levels for as long as necessary,” the Governing Council said Thursday in a statement.

Officials also confirmed that they’ll halt reinvestments under their €3.2 trillion ($3.5 trillion) Asset Purchase Program from next month — another tightening move that was flagged at May’s policy meeting.

To summarize: overall, the statement is very much as expected with the ECB hiking by 25bp and remaining data dependent while acknowledging the ongoing and expected impact of policy transmission. The inflation projections and commentary are more interesting and clearly lean hawkish. Specifically, the marked upgrades to the core (Ex-Food/Energy) HICP projection even though the council outlines that there are some tentative signs of softening in underlying pressures, is a clear hawkish signal.

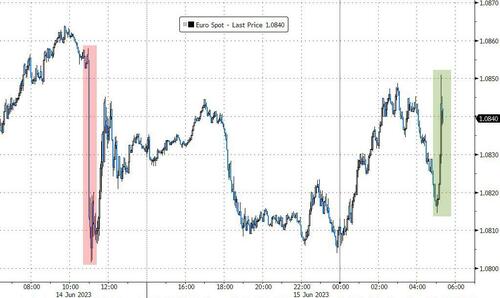

The kneejerk reaction in the markets is EUR strength – erasing much of yesterday’s post-Fed losses…

… while Bund Sep’23 futures fell from 132.68 to 132.45. before extending to 132.20 over 10-minutes; the BTP-Bund yield spread widened from 165.60 to 169.00 before paring back towards 166.00.

Watch ECB President Christine Lagarde explain the hawkish forecast here; keep an eye for any clues around July and beyond, though Lagarde will likely return attention to the above statement and reiterate a data dependent approach. That said, the hawkish projections perhaps make it hard for her not to give some form of hat-tip towards further tightening and indeed market pricing continues to show a circa. 65% chance of a 25bp hike in July.

Loading…

https://www.zerohedge.com/markets/ecb-hikes-rates-expected-unexpectedly-raises-inflation-outlook-amid-eu-recession