By Garfield Reynolds, Bloomberg Markets Live reporter and strategist

US equities’ rally to the highest in more than a year has been at least partly driven by sustained expectations that moderating inflation will soon bring the Federal Reserve’s tightening cycle to an end. That ignores the potential that slowing inflation signals a significantly weaker economic outlook than what’s being priced in.

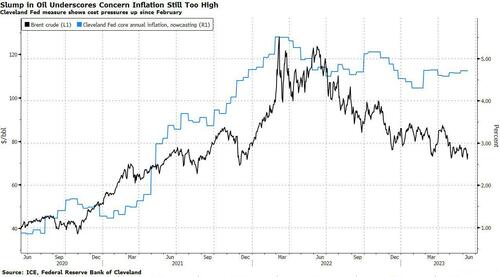

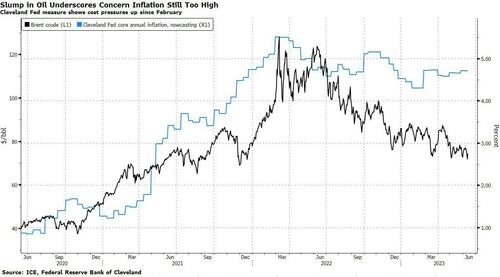

The rally seemingly shows no fear that Tuesday’s US CPI readings could come in hot enough to provoke a fresh hawkish tack from the Fed. But in many ways, the concern should be more about the medium term. The Cleveland Fed’s nowcast for PCE core inflation — the gauge itself being the indicator that policymakers focus on — has actually climbed since February when it hit the lowest since 2021. And that’s come even as crude oil declined despite OPEC+ output cuts.

That makes for a toxic mix for growth. Inflation readings that are strong enough to keep the Fed biased toward further hikes at a time when weakening oil demand underscores the downside risks for the global economy.

The concern remains that the rally in risk assets fails to account for the potential that a drop in inflation sufficient to convince the Fed to stop hiking can only come with a sustained slump for the economy.

* * *

Even though Tuesday’s CPI release showed a significant drop – as widely expected – it still leaves inflation much higher than the Fed’s goals (at least until the Fed raises its inflation target). As Reynolds concludes, “stock investors may ultimately regret getting what they are wishing for.”

Loading…

https://www.zerohedge.com/markets/sliding-oil-sticky-inflation-spell-danger-exuberant-stocks