What could go wrong?

Given the ‘transitory’ snafu and endless blind bubble-creation – and the accompanying banquet of unintended consequences – no lesser mortal than Mohamed El-Erian has been highly critical of the Fed for the past year, asserting that the institution “has slipped in its analysis, forecasts, policymaking and communication” and has made “one mistake after another.”

“The Fed’s problems should worry everyone. A loss of credibility directly affects its ability to maintain financial stability and guide markets in a manner consistent with its dual mandate of maintaining price stability and supporting maximum employment.”

So, how do they plan to help regain that credibility?

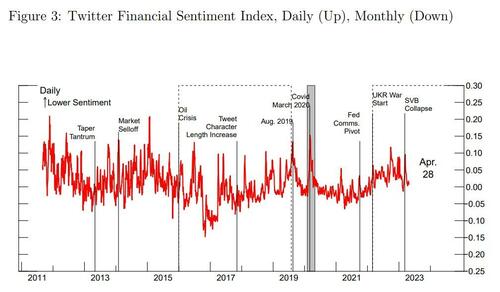

Fed researchers have developed a new measure of real-time credit and financial market sentiment from Twitter data that they say can help forecast changes in the stance of monetary policy, and can help estimate next-day stock-market returns.

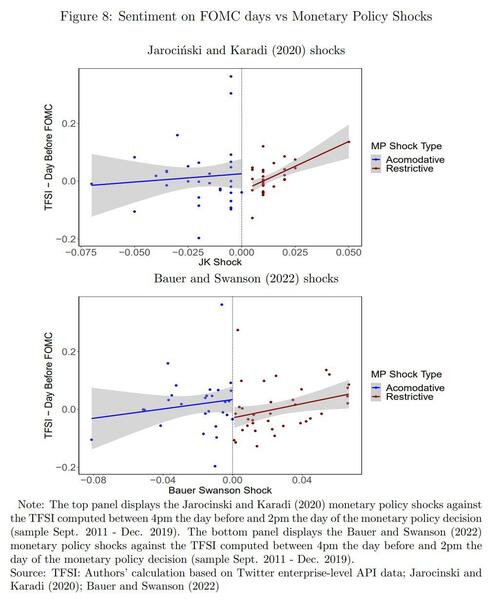

“Twitter sentiment after the first day of the FOMC meeting can predict the size of restrictive monetary policy shocks in connection with the release of the FOMC statement the following day,” economists Travis Adams, Andrea Ajello, Diego Silva and Francisco Vazquez-Grande said.

As they conclude:

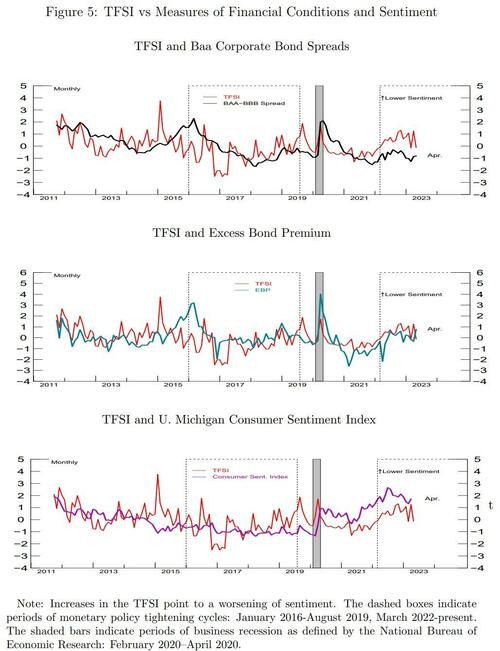

“We show that the TFSI correlates with indexes and market gauges of financial conditions at monthly frequency. We also show that overnight twitter sentiment can help predict daily stock market returns. Finally, we show that Twitter financial sentiment can predict the size of restrictive monetary policy surprises.”

Just imagine the reflexive group-think circularity that this kind of sentiment indicator could enable – “see we should keep cutting because everyone loves it…”?

Read the full paper below:

Loading…

https://www.zerohedge.com/markets/fed-builds-real-time-financial-twitter-sentiment-index