By Akshay Chinchalkar, Bloomberg Markets Live reporter and strategist

The recent breakout in the US 10-year yield may have 4% within its sights.

The benchmark rate completed a seven-day rising streak through yesterday against the backdrop of negotiations around the debt ceiling. Although Monday’s talks proved inconclusive, both President Biden and House Speaker Kevin McCarthy expressed optimism about engaging in “productive” discussions that should eventually help reach an agreement and resolve the impasse.

So, where to now for yields? The streak itself is sending mixed signals, depending on where in history one looks for precedence. Between the period Jan. 1, 2001 to March 9, 2020 – the day of the Covid-crash lows – the seven-day rising streak was seen a total of 19 times. In 17 of those occurrences, the yield was down over the following 20 days for an average of 15 basis points — so a shot in the arm for bond bulls. But the period since then has seen five such streaks – excluding the current signal – with yields rising an average of 42 basis points over the next 20 days, leaving bond optimists with a 100% loss record. With Treasury Secretary Yellen’s X date of June 1 rapidly approaching, history doesn’t seem to be helping much with what comes next.

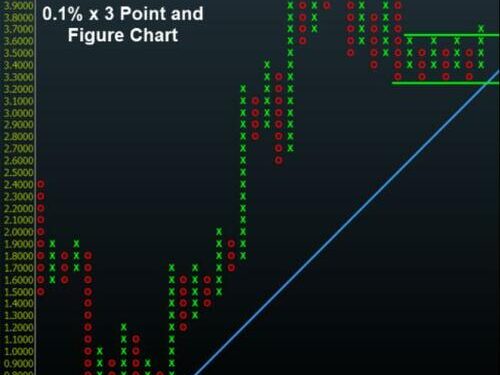

Last week’s breakout on the point-and-figure chart leaves no doubt though. The most recent slide in the 10-year yield bottomed out at a significant support area with the subsequent rally breaking above a pivotal upside barrier, a classic case of support holding and resistance giving way. Notice also that the decline from the October peak of 4.33% didn’t break below the long-term, rising 45-degree support line drawn off the November 2020, double-bottom lows. That turns the tactical focus on the next important hurdle at 3.90% – 4.00%.

Point and figure analysis is a charting method which highlights the direction of prices – up in a column of Xs and down in a column of Os – without a time dimension. It does so by using two parameters – the box size and the reversal size. The box size is the minimum move that must occur for the current column to increase in length, while the reversal size defines the size of an opposing move that must occur for the column to change direction.

In our example that uses the US 10-year yield, the box size is set to 0.1% – the value of each X and O – and the reversal size is set to 3 boxes.

The current column has 4 Xs which means that yields have risen by 0.1% x 4 = 0.4% from the lowest O in the previous column. In doing so, they have broken above the level where three prior columns of Xs peaked out, thereby clearing resistance. Notice how support held when the immediately previous column of Os troughed at a level where past columns of Os had bottomed.

The upside breakout will be suspect if yields drop immediately to 3.40% or less from current levels. A print of 3.80%, on the other hand, will fortify the odds of yields going toward 4%. Federal Reserve Bank of St. Louis President James Bullard said Monday that two more rate hikes may be needed to bring inflation down to the central bank’s target of 2%. For now, that’s the path that the US 10-year seems to be latching onto.

Loading…

https://www.zerohedge.com/markets/10-year-yield-seeking-higher-ground-technical-breakout