On Jan 31, just one day before a dovish Powell presser sent stocks surging higher in what to this date remains the biggest short squeeze in a decade, boosted by a historic 0DTE buying frenzy, the “Big Short” Michael Burry tweeted one word: “sell.”

Then, when stocks spiked higher, Burry promptly deleted not just the tweet but his entire account, only to reactivate it one week later for yet another sarcastic tweet, suggesting that this time was no different than the dot com crisis (the tweet has also since been deleted).

In retrospect, it may have been a little bit different after all because with just hours left to the end of the first quarter, Burry again flipped, and informed his audience – with one of his patented self-destructing tweets – that he was “wrong to say sell”…

…. which incidentally is something we predicted just two weeks prior when days after the SVB failure when the Fed panicked and injected $400 billion in reserves into the system, we warned that the “chase begins” just as stocks were about to ramp higher, not lower as so many expected would be the obvious, logical outcome to the biggest financial crisis since Lehman.

Chase begins pic.twitter.com/DLPt5w8DG4

— zerohedge (@zerohedge) March 17, 2023

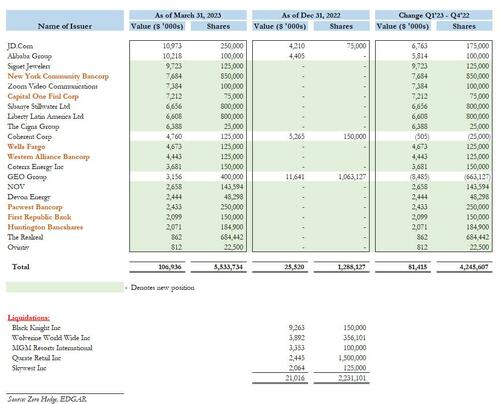

In any case, fast forward to today some 45 days after the end of the quarter – better known as 13F filing time – when we found out just why Burry was “wrong to say sell”: according to his latest SEC filing, his Scion Capital was busy buying stocks in Q1. In fact, at $106 million in notional value of his disclosed positions, this was Burry’s biggest buying spree in years.

Looking at Scion’s latest 13F reveals that once again Burry liquidated the rest of his legacy 2022 holdings, dumping his entire stake in companies like Black Knight, Wolverine World Wide, MGM Resorts and Qurate; he also trimmed his formerly largest holding, private prison operator GEO group, and reallocated the proceeds in three ways

- Adding to his Chinese exposure, making JD.com and Alibaba his top stocks (a move which appears to have been driven by the Q4 momentum and which has since fizzled, leading to substantial losses in Chinese names).

- Launching a handful of new positions in energy names such as Coterra, NOV and Devon

- Most notably, a third – or seven of the fund’s total 21 positions – were financial names, and with the exception of Wells, they were mostly distressed, regional, small banks and/or credit card companies, such as CapitalOne, Western Alliance, Pacwest, First Republic, and Huntington Bancshares.

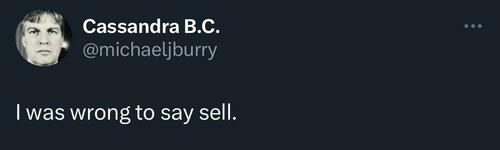

Unfortunately for Burry, one of those banks is already a doughnut which means that unless he promptly sold out of his FRC stake, Burry is down some $2 million on this particular bank. As for the others, they may yet bounce but so far they have not. Meanwhile, as we showed yesterday, as long as QT continues, so will the deposit drain which is mostly hitting small and regional banks, and will inevitably lead to many more failures…

… unless the Fed suddenly decides it has unleashed enough bank sector destruction and reverses, cutting rates and restarting QE. Point being Burry appears to have enough of being called the “big short” and in this particular twist of the liquidity cycle is positioning himself to be the next “big long.”

Here is a summary of Scion’s holdings as of March 31.

Source: SEC

Loading…

https://www.zerohedge.com/markets/michael-burry-didnt-sell-instead-he-loaded-regional-banks-here-are-all-big-shorts-latest