Earlier today we excerpted from two recent reports, one from BofA and another from Goldman, both of which were rather optimistic when it comes to both Q3 earnings season and corporate profits beyond. Not everyone, however, shares their enthusiasm. According to a duo of far more bearish strategists from Morgan Stanley and JPMorgan, the outlook for earnings is weakening and could remain subdued.

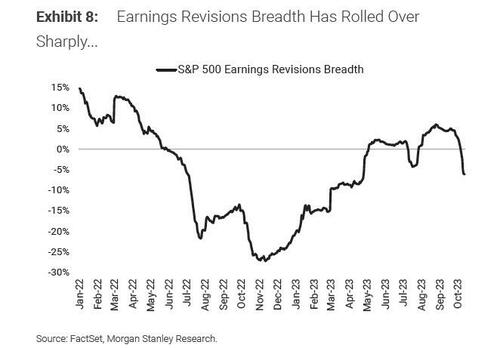

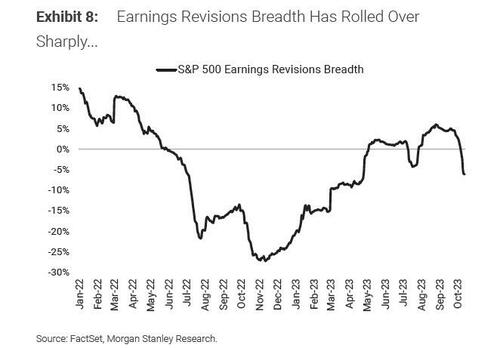

As the reporting season kicks off, in his latest weekly note (available to pro subscribers) Morgan Stanley’s resident permabear Michael Wilson said the earnings revisions breadth – referring to the number of stocks seeing upgrades versus downgrades – for the S&P 500 has fallen sharply over the past couple of weeks.

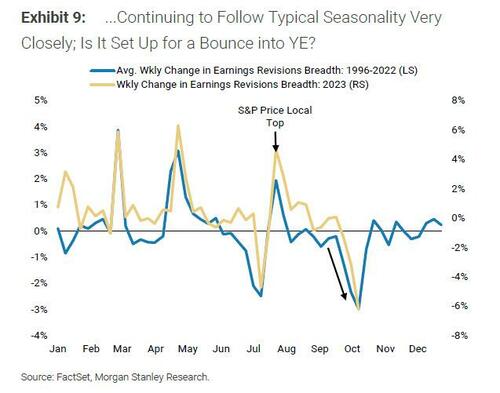

And since this is a time of year when earnings revisions tend to see an upward inflection in breadth…

… further underperformance “would be a sign that other cyclical risks including macro headwinds are driving the earnings revisions backdrop,” Wilson wrote in the note.

Meanwhile, as Bloomberg’s Sagarika Jaisinghani observes, JPMorgan’s equally bearish strategist Mislav Matejka points to Citigroup’s index of earnings revisions which shows that downgrades have outpaced upgrades for four straight weeks ahead of the reporting season, and expects this trend to continue.

“Most recently, EPS revisions appear to be weakening again in the US and Eurozone,” Matejka wrote in a note. “We think this downtrend could continue.”

The bearish views are in contrast to a more optimistic tone from analysts ahead of the season, which kicked off Friday with banking giants including JPMorgan. Upcoming results will further reveal how companies have managed headwinds such as higher interest rates and slowing consumer demand.

The prospect of higher-for-longer interest rates has unnerved markets this month, with the 10-year Treasury yield hitting the highest in more than a decade. Investors are bracing for the Federal Reserve to keep policy tight, rekindling recession concerns that have been heightened by conflict in the Middle East.

Still, RBC Capital Markets strategist Lori Calvasina said that the reporting season is off to a good start in terms of stock price reactions, even though earnings-per-share revisions have turned slightly negative and commentary suggests the uncertain macroeconomic backdrop is taking a toll on companies. Out of the few S&P 500 companies which reported so far, 88% have beaten estimates according to Bloomberg data.

Calvasina slightly lifted her S&P 500 earnings-per-share forecast for 2023 and 2024. “Our 2024 forecast assumes a significant moderation in inflation, easing of interest rate pressures in the back half of the year, and sluggish GDP and industrial production forecasts,” she wrote in a note.

To be sure, early results show a “strong start” to the quarter, according to BofA’s Savita Subramanian, who said the S&P 500 companies that have reported so far are tracking a 1% beat led by Banks, with reported results coming in 9% above consensus (+2% ex-Financials).

And while analysts predict S&P 500 companies will report a 0.8% drop in third-quarter earnings from a year ago before a 6.2% rebound in the final three months of the year, we are likely to see a sharp hockeystick during earnings season due to the usual sandbagging and expectation cuts ahead of earnings to make beats more likely.

“We look for company guidance to provide more clarity on 4Q expectations, which should in turn set the tone for the 2024 revisions,” Wilson wrote.

Loading…

https://www.zerohedge.com/markets/strategists-sound-alarm-dimmer-profit-outlook