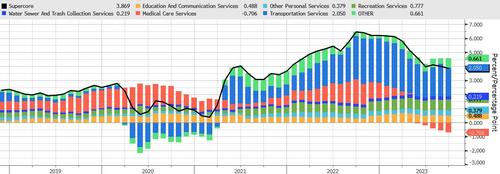

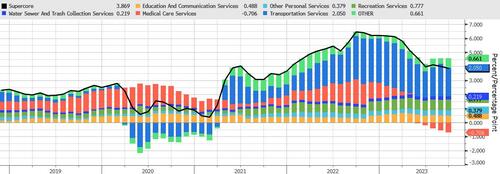

There are two diverging views following today’s CPI print: the first looks at the hotter headline inflation (which beat expectations on both a MoM and YoY basis) and argues that the Fed will have to hike at least once more. The second counters by pointing to the continued slowdown in supercore inflation…

… and notes that excluding shelter, which as we noted continues to lag real-time data by 12 months at a time when rents are now dropping…

CPI and its stale data: “The shelter index increased 7.2 percent over the last year, accounting for over 70% of the total increase in all items less food and energy.”

Meanwhile, real-time rent indicators are in freefall. Apt List’s Sept rent drop was the biggest on record pic.twitter.com/WXwFAKfJv5

— zerohedge (@zerohedge) October 12, 2023

… core CPI is up just 0.1%.

For a more granular view of Wall Street’s takes, here is a snapshot of some of the initial hot takes from a variety of traders, economists and strategists.

Capital Economics

Excluding shelter, the core CPI rose by just 0.1% m/m. Overall, there is nothing here that will convince Fed officials to hike rates at the next FOMC meeting, and we continue to expect a more rapid decline in inflation and weaker economic growth to result in rates being cut much more aggressively next year than markets are pricing in.”

CBK:

“US inflation is cooling, but only slowly. From the perspective of the Fed, the figures are probably not worrying enough to trigger another interest rate hike. However, they are not good enough to sound the all-clear either.”

MUFG, George Goncalves

“The Fed is done as its recent commentary suggests a shift from already thinking of moving from how high to how long. The data and recent Fed speak means it looks hard to get 10s to make a run towards 5 again — not impossible — but the double top in rates in September might prove to be the near-term high.”

Richard Bernstein Advisors

“This is one of those reports that will be forgotten almost immediately. It’s always important to keep in mind that the Fed will be responding to inflation, which in turn responds to growth, so it makes more sense to focus on the head of the snake than the tail.”

BMO Capital Markets

“Overall, it was a firm read on realized inflation that reinforces the Fed’s recent messaging regarding the need to keep policy rates in restrictive territory for an extended period of time. The unchanged initial jobless claims print of 209k also reinforces the Goldilocks narrative.”

Bloomberg Economics

“The September CPI report won’t convince Fed officials that interest rates are sufficiently restrictive. There’s some encouraging disinflation progress in the goods sector, but not so much in services, where rents disinflation stalled. The Israel-Hamas conflict has now tipped the balance once again toward upside inflation risks. Our baseline is for the Fed to hold rates steady for the rest of the year, but we see non-negligible risks of another rate hike, something the market is probably underpricing.”

Premier Miton Investors

“The core rate for September came in as expected and this will allow the Fed to proceed carefully from here. Overall, the economy remains robust in the face of tighter policy, supported by the jobs market. Those looking for a soft landing will not be disappointed by this number, but they will not want to see it moving any higher.”

JPM Asset Management

“The report was almost exactly in line with expectations. The economy is on track for a year-over-year headline CPI being 2% or less in the fourth quarter of next year. This is one year ahead of the Fed’s target.“

Charles Schwab UK

“While the lack of a fall in the rate may be disappointing to the Fed, it is likely not surprising following last week’s jobs report, which showed that the labor market remains hot — a factor that can put upward pressure on prices. Whether or not the Fed opts for hikes, it’s unlikely we’ll see rates drop below where they are for as long as the inflation dragon proves difficult to slay.”

Loading…

https://www.zerohedge.com/markets/nothing-here-convince-fed-hike-november-wall-street-reacts-todays-cpi