Tl;dr: The Minutes echoed the hawkish tone of the statement and press conference: “a majority” of Fed officials saw one more rate increase “would likely be appropriate”.

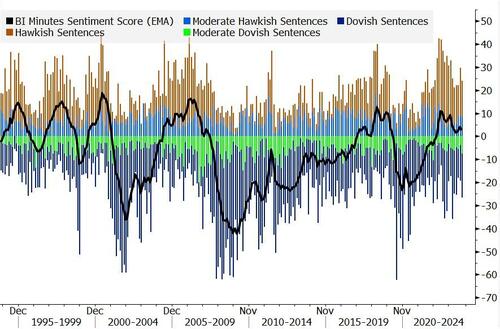

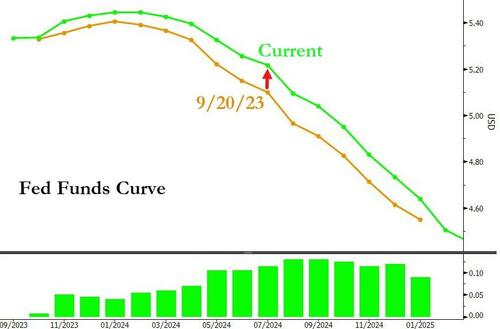

The Bloomberg Intelligence US interest-rate strategy team’s NLP model of the minutes showed the Fed was somewhat more dovish than at the July meeting, with the exponential moving average declining back to levels experienced for the June FOMC gathering.

“Overall, we didn’t see many surprises in the minutes,” BI Chief Interest Rate Strategist Ira Jersey says.

“With the model suggesting the Fed is neutral, another pause at the November meeting seems most likely unless tomorrow’s CPI data is shockingly high.”

* * *

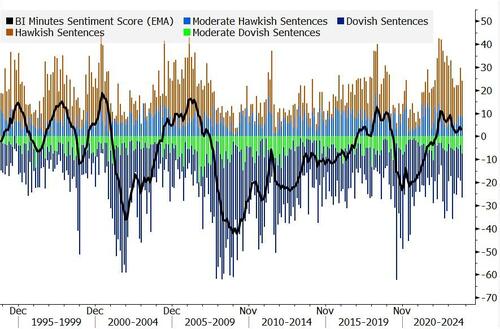

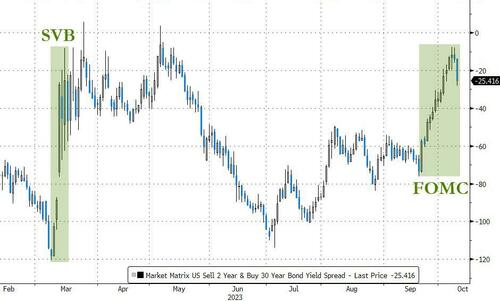

Since The FOMC meeting on September 20th, when the various Fed members dropped their now infamously hawkish SEP (dot plot), things have gone just a little bit turbo across asset-classes.

The dollar is marginally stronger… and everything else is lower in price (with bonds and gold leading the charge lower)…

Source: Bloomberg

The ‘higher for longer’ narrative gained ground since the hawkish statement with the STIRs curve up around 10bps…

Source: Bloomberg

Interestingly the long-end of the yield have risen dramatically in the weeks since the last FOMC meeting (and we suspect spooked Fed members). Over the same period, 2Y Yields are down 8bps (30Y +33bps)…

Source: Bloomberg

That’s a dramatic steepening of the curve…

Source: Bloomberg

And finally, financial conditions have steepened notably in the weeks since the FOMC (though the last 2 days of flight to safety post-Israel has eased it back a little)…

Source: Bloomberg

Since the hawkish SEP, various Fed speakers have attempted – albeit very modestly – to tamp down the tone (because we suspect the rampant surge in long-end yields spooked some of them). Will the Minutes attempt to do the same with cherry-picked comments?

In fact, Powell was actually fairly balanced in his open remarks at the press conference, so we wouldn’t be surprised if the minutes had more statements of risk, fitting with the post-FOMC FedSpeak.

Arguably, the Minutes suggest there is more of a two-sided argument for policy action (pause vs more hikes – not hikes vs cuts) than the tone at the statement and press conference, while most participants continued to see upside risks to inflation.

Policy

-

A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate, while some judged it likely that no further increases would be warranted.

-

Many participants noted data volatility, potential data revisions as supporting case for proceeding carefully in determining extent of additional tightening.

-

Several participants commented that with policy rate at or near peak, decisions and communications should shift to how long rates stay restrictive versus how high they will rise.

-

Several participants noted balance sheet run off could continue for ‘some time,’ even after rate cuts begin.

Economy

-

Many participants saw continued downside risks to economic activity and upside risks to the unemployment rate.

-

Vast majority’ of participants continue to judge the future path of the economy as ‘highly uncertain’.

-

Many participants saw continued downside risks to economic activity and upside risks to the unemployment rate, those risks included longer lag effects from financial tightening, effect of union strikes, slowing global growth and continued weakness in commercial real estate.

-

Participants still saw below-trend growth, softer labour market as necessary to restoring economic balance.

Fed Staff

-

Fed staff economic forecast was stronger than July projection on resilient consumer and business spending.

-

Fed staff assumed GDP growth for rest of 2023 would be damped a bit by UAW strike, with effects unwound in 2024.

-

Yields on medium- and longer-term nominal Treasury securities rose more substantially, mainly reflecting higher term premiums and higher real yields.

China

-

In China, signs of strain in the property sector increased, and optimism about growth diminished further, on net, although broader markets, including global commodity markets, did not appear to show elevated concern about China-related risks.”

Forecasting is hard

-

Many noted data volatility and potential data revisions, or the difficulty of estimating the neutral policy rate, as supporting the case for proceeding carefully in determining the extent of additional policy firming that may be appropriate.

…And you think they don’t watch stocks?

-

U.S. financial conditions tightened, with higher longer-term rates, lower equity prices, and a stronger dollar contributing roughly equally to the increase in various financial conditions indexes.

Read the full minutes below:

Loading…

https://www.zerohedge.com/markets/fomc-10