Shares of Lucid hit record lows in New York this week as concerns mount about ongoing demand woes for its Air electric luxury sedan. A new report reveals Lucid loses a staggering $338k per unit.

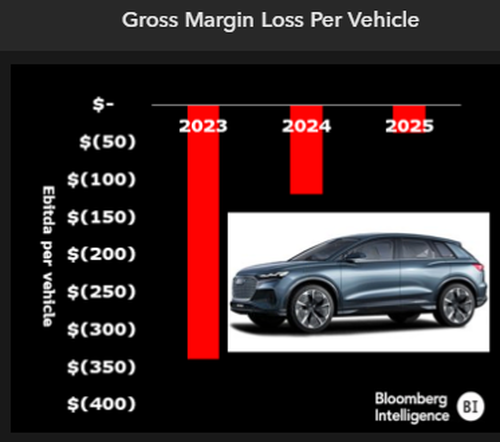

According to Bloomberg Intelligence, “Lucid may burn $338,000 per vehicle in EBITDA this year, an increase from $325,000 just months ago, demonstrating how its unsustainable business model requires significant scaling and additional funding — likely before 2025.”

Even though Lucid can compete with more prominent brands like Tesla, Mercedes, and Porsche, the real question is whether its largest shareholder, the Kingdom of Saudi Arabia, will continue funding the troubled EV maker amid a price war sparked by Elon Musk earlier this year.

Lucid will continue to lose money through 2025, adding pressure to its liquidity and access to capital: A warning sign that any economic downturn could accelerate the demise of the money-losing company.

In May, EV blog Electrek quoted Tesla owner Elon Musk, who, at the time, believed an EV bankruptcy wave was nearing:

It’s going to be a challenging 12 months. I want to be realistic about this. Tesla is not immune to the global economic environment. The macroeconomics levels are going to be difficult for the next 12 months.

In June, Lordstown Motors filed for bankruptcy. Days ago, Rivian announced plans to raise $1.5 billion in convertible notes to shore up its balance sheet.

Some good news for Lucid: BI said the EV maker “should benefit from the introduction of the Gravity in late 2024 and a potential midsize platform in 2025, yet perhaps its best near-term tool is to consider more supplier and licensing deals like it has done with Aston Martin. Inventory levels are rising due in part to production exceeding deliveries, logistics and higher raw materials, and that is concerning as it may eventually add to price pressures. Lucid’s three-row SUV, the Gravity, is due for deliveries in 2024 and an expected competitor to Tesla’s Model S may start with a price tag about 25% higher than its rival.”

However, Jerry Braakman, chief investment officer at First American Trust, said in an interview, “Lucid is well below the pace needed to hit even 10,000 cars this year, and that’s why they continue to bleed money.”

Braakman added, “The stock will continue to be challenged until they can show that they have made a significant progress in the number of units sold.”

Tesla is winning the EV price war. Lucid’s fate hangs in the balance if the Saudis want to keep funding the money-losing operation.

Loading…

https://www.zerohedge.com/markets/unsustainable-business-lucid-loses-338000-vehicle-tesla-price-war-heats