Rate-change expectations shifted hawkishly today, after drifting dovishly for the last week, on the heels of the Manufacturing PMI’s report which showed the rate of inflation quickened to the sharpest pace in five months and FedSpeak which confirmed Powell’s “higher for longer” messaging.

Source: Bloomberg

In the US, S&P Global noted

“Less encouraging was the news on the inflation outlook, as producers’ costs rose at the fastest rate for five months, largely on the back of higher oil prices. These increased costs are already feeding through to higher prices to customers, which will inevitably result in some renewed upward pressure on inflation.”

Globally, JPMorgan warned that there were further signs of price pressures building in September.

Input costs and output charges both rose for the second consecutive months, with rates of inflation accelerating for both measures.

Fed Gov Michelle Bowman again said that multiple interest-rate hikes may be required to get inflation down:

“I continue to expect that further rate increases will likely be needed to return inflation to 2% in a timely way,” Bowman said in remarks prepared for delivery to bankers in Banff, Canada.

“I see a continued risk that high energy prices could reverse some of the progress we have seen on inflation in recent months.”

Fed Vice Chair Michael Barr said the US central bank is “likely at or very near” a level of interest rates that is sufficiently restrictive:

“I think it is likely that we’ll need to keep rates up for some time in order to get inflation down to 2%. I’m confident that we’ll get there.”

Traders were buying protection against a less-hawkish Fed. Bloomberg notes significant SOFR flows on the day have been skewed toward dovish protection into year-end, standing to benefit from no more additional rate hikes from the Fed.

The hawkish shift sent the dollar higher, rallying back up to perfectly tag the stops from Wednesday highs…

Source: Bloomberg

The stronger dollar weighed on crude oil prices, with WTI sliding back below $89, as Citi’s Ed Morse muttered something about Oil “going back to the $70s” as “demand looks constrained as the pandemic recovery factors continue to ease off and peak transport fuel demand looms, while supply is growing in non-OPEC+ suppliers”

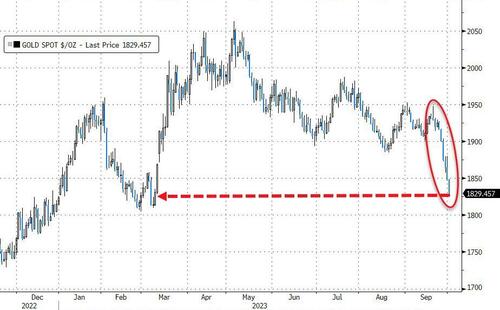

And gold was dumped to fresh cycle lows, selling off for the 6th day in a row (9th drop in the last 10 days)…

Source: Bloomberg

Spot Platinum prices plunged to their lowest since Oct 2022…

Source: Bloomberg

Treasuries were sold across the board with the belly (5s-10s) suffering the most…

Source: Bloomberg

Which steepened the yield curve (2s10s) to its least-inverted since the peak of the SVB crisis…

Source: Bloomberg

The 10Y Yield broke above 4.70% – its highest since 2007

Source: Bloomberg

Just thinking out loud – if this is a new rate-cycle… like the last one… then this could be a transitory peak, and bonds rally to Aug ’24 before taking off for good…

Source: Bloomberg

Bitcoin continued to drift higher, spiking above $28,500 intraday

Source: Bloomberg

Stocks were very mixed on the day with Small Caps clubbed like a baby seal while Mega-Cap tech outperformed leave The Dow and S&P trying to get back above water…

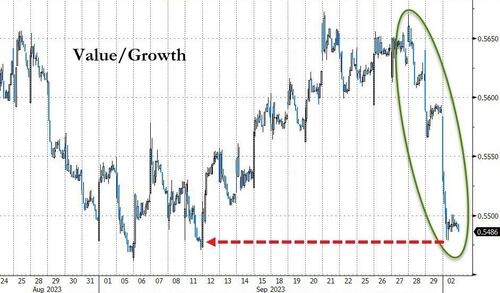

Value stocks puked relative to Growth, erasing their recent gains…

Source: Bloomberg

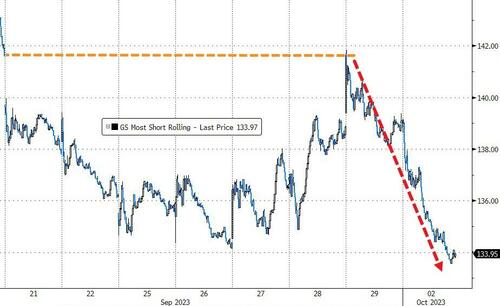

‘Most shorted’ stocks were hammered for the second day in a row with no squeeze attempts…

Source: Bloomberg

Utes were the biggest losers today (NEE’s plunge did not help) and Tech stocks were the only sector to end green…

Source: Bloomberg

That’s quite a puke in Utes…

Source: Bloomberg

CART’d Out…

Goldman’s data could hint at capitulative flows: CTAs as short $17.8bn of global equities (31st %tile), while In the US, CTAs are short $17.5bn of equities after selling -$59bn over the last two weeks, representing the largest two week selling since Covid!

After a massive $59BN in selling in past 2 weeks (as noted two weeks ago), systematics have fully liquidated. CTAs are all uphill from here.

Also dealer gamma almost back to positive after hitting record negative last week.

Bounce imminent. https://t.co/NqhdUPxLHA pic.twitter.com/akhbQO9Wu4

— zerohedge (@zerohedge) October 2, 2023

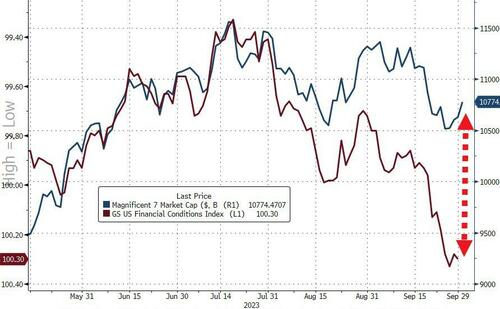

And finally, financial conditions continue to tighten, suggesting stocks may have more room to run to the downside…

Source: Bloomberg

Is that the ‘deflation’ that Powell is looking for?

Loading…

https://www.zerohedge.com/markets/bonds-bullion-black-gold-battered-hawkish-fedspeak-inflation-fears-lift-dollar