- European bourses trade softer following a predominantly negative close yesterday as a lack of positive catalysts keeps sentiment suppressed.

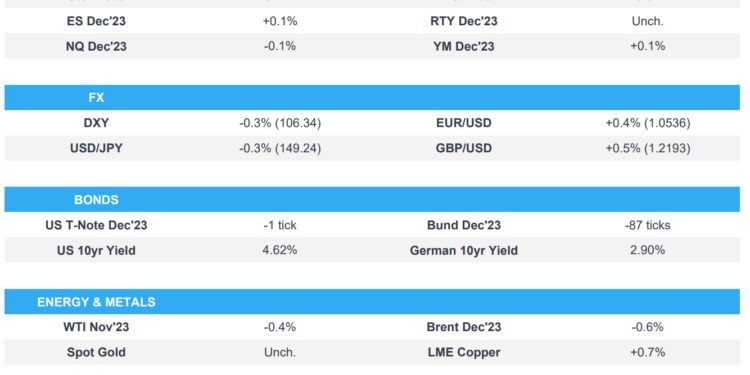

- DXY settled down under 106.50 after extending gains on Wednesday when various bullish impulses combined to boost the Buck.

- Bunds and Gilts have been in freefall alongside Eurozone periphery debt, the T-note managed to tread water for the most part.

- US Senate is to vote today at 16:30BST/11:30EDT on a motion to proceed with the “shell” bill to avoid a shutdown, according to Fox News’ Chad Pergram.

- Looking ahead, highlights include German CPI, US GDP (Final), US IJC, Banxico Policy Announcement, Fed’s Powell, Goolsbee, Cook & Barkin, Supply US, Earnings from Nike, Carmax & Accenture.

28th September 2023

- Click here for the Newsquawk Week Ahead summary.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses trade softer following a predominantly negative close yesterday as a lack of positive catalysts keeps sentiment suppressed.

- Sectors in Europe have a mostly negative tilt with Travel & Leisure at the bottom of the pile after feeling the pressure from higher energy prices. On the upside, Energy and Basic Resources outperform.

- US futures are trading modestly weaker, paring back gains seen in yesterday’s session. The docket for today picks up, with US Core PCE Prices (Final), GDP (Final) and weekly IJC’s all due at the busy 13:30 BST / 08:30 ET slot.

- Click here for more details.

FX

- DXY settled down under 106.50 after extending gains on Wednesday when various bullish impulses combined to boost the Buck.

- Pound benefits from a sharper rebound in UK yields relative to the US and Eurozone as Cable bounced to 1.2206, with GBP 1.5bln in opex rolling off at 1.2200 strike.

- EUR manages to hold its head above YTD lows at 1.0482 amid another slide in EGBs alongside mixed MM inflation data from German states.

- Yen regains some poise within a 149.63-22 range while Yuan was bolstered by the PBoC overnight as it set an even more skewed midpoint reference rate and injected a bumper amount of pre-holiday liquidity.

- Click here for more details.

- Click here for the Option Expires for the NY Cut.

FIXED INCOME

- The T-note managed to tread water for the most part within a 107-27/15+ range and perhaps with some leverage from blocked curve flatteners.

- Bunds and Gilts have been in freefall alongside Eurozone periphery debt. The 10 year German and UK benchmarks breached deeper chart and psychological supports on the way down to 127.60 and 93.43 respectively.

- Angst in BTPs was prompted by Italy’s budget and exacerbated by month-end supply, but the latest collapse elsewhere looks more momentum-based and technically driven given no obvious fresh fundamental catalyst.

- Italy sold EUR 8bln vs exp. EUR 7-8bln 4.10% 2029, 4.20% 2034 BTP Auction & EUR 1.5bln vs exp. 1-1.5bln 2026, 2030 CCTeu Auction.

- Click here for more details.

COMMODITIES

- Crude futures have waned off best levels in early European hours following a respectable rally yesterday.

- Spot gold remains suppressed by the recent rise in the Greenback, with prices drifting lower yesterday before finding stability around the USD 1,975/oz mark, with the yellow metal moving sideways on either side of the level overnight and in European trade.

- Base metals are firmer across the board with some noting of potential demand as China enters its long Mid-Autumn festival holiday break starting from tomorrow.

- Russian Energy Minister said the ban on fuel exports will last until the market stabilises and additional measures could be taken on the fuel market, according to Tass.

- Saudi Aramco is to enter the global LNG business by acquiring a stake in Midocean Energy for USD 500mln, according to Reuters.

- Some Japanese aluminium buyers agreed October-December premium at USD 97/tonne, -28% QQ, according to Reuters.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- France is exploring a windfall levy to take back control of energy prices, according to FT.

- European Commission VP says the exact scope of the probe into Chinese EV imports has not been decided yet, when asked if Tesla (TSLA) will be impacted by the probe, via CNBC.

EUROPEAN DATA RECAP

- German state CPIs YY were in line with expectations for the national metrics, which forecasts a marked cooling; MM state CPI metrics were mixed against the expectations for the nationwide figure.

- Spanish CPI YY Flash NSA (Sep) 3.5% vs. Exp. 3.5% (Prev. 2.6%); Core CPI YY (Sep) 5.8% (Prev. 6.1%)

- Spanish CPI MM Flash NSA (Sep) 0.20% vs. Exp. 0.30% (Prev. 0.50%)

- Spanish HICP Flash YY (Sep 2023) 3.2% vs. Exp. 3.3% (Prev. 2.4%)

- Spanish HICP Flash MM (Sep) 0.6% vs. Exp. 0.6% (Prev. 0.5%)

- EU Business Climate (Sep 2023) -0.36 (Prev. -0.33)

- EU Consumer Confid. Final (Sep 2023) -17.8 vs. Exp. -17.8 (Prev. -17.8)

- EU Services Sentiment (Sep 2023) 4.0 vs. Exp. 3.5 (Prev. 3.9)

- EU Industrial Sentiment (Sep 2023) -9.0 vs. Exp. -10.5 (Prev. -10.3)

- EU Economic Sentiment (Sep 2023) 93.3 vs. Exp. 92.5 (Prev. 93.3)

- EU Selling Price Expec (Sep 2023) 3.6 (Prev. 3.6)

- EU Cons Infl Expec (Sep 2023) 12.0 (Prev. 9.0)

NOTABLE US HEADLINES

- White House Economic Adviser Bernstein said the US economy faces headwinds from a possible shutdown, student debt restart, higher interest rates and the UAW strikes. Bernstein also commented that the US economy is expected to keep going in a pretty good way barring a policy mistake or exogenous shock, according to Reuters.

- US Senate is to vote today at 16:30BST/11:30EDT on a motion to proceed with the “shell” bill to avoid a shutdown, according to Fox News’ Chad Pergram.

- Click here for the US Early Morning Note.

GEOPOLITICS

- North Korea convened the Supreme People’s Assembly and discussed an amendment to the constitution to stipulate the position of nuclear force in national defence, while it stated that it is important to accelerate the modernisation of nuclear weapons for strategic deterrence against the US. Furthermore, North Korean leader Kim called for reinforcing relations with countries that oppose US hegemony and said increasing production of nuclear weapons is an urgent task, according to KCNA.

- US and Japan warned of China-tied hackers hiding in router software, according to Bloomberg. In relevant news, a US Senate staffer said 60,000 emails were stolen from the US State Department in the 2023 hack of Microsoft’s (MSFT) platform and Chinese hackers allegedly broke into ten US State Department accounts earlier this year.

- Chinese Foreign Ministry said the third financial dialogue with Germany slated for Oct 1st, according to Reuters.

- China’s Defence Ministry said Beijing is to hold regional security dialogue Xiangshan forum on Oct 29-31, according to Reuters.

- China Defence Ministry on joint drill in Yellow Sea by the US and its allies said they conducted proactive military activities on China’s doorstep and China will not sit idly aside, according to Reuters.

CRYPTO

- Bitcoin trades flat intraday around the USD 26,300 mark following yesterday’s choppy price action.

APAC TRADE

- APAC stocks traded mixed following the indecisive performance in the US heading into month and quarter-end amid further upside in global yields and higher oil prices.

- ASX 200 pared initial gains as strength in the commodity-related sectors was offset by the upside in yields and weakness in consumer stocks after retail sales missed forecasts.

- Nikkei 225 underperformed after it slipped beneath the 32,000 level and amid mass ex-dividend day in Japan concerning over 1,400 companies.

- Hang Seng and Shanghai Comp diverged amid headwinds in the property sector after the suspension of shares in Evergrande and some of its units, while the mainland was kept afloat after the PBoC’s liquidity injections ahead of the holiday closures and following China’s latest support pledges.

NOTABLE ASIA-PAC HEADLINES

- PBoC set USD/CNY mid-point at 7.1798 vs exp. 7.3239 (prev. 7.1717)

- HKEX announced shares of Evergrande (3333 HK), Evergrande Property Services (6666 HK) and Evergrande New Energy Vehicle (708 HK) have been suspended.

- China’s cyberspace regulator has issued draft rules on promoting draft riles on promoting and regulating the cross-border flow of data; companies providing more than 1mln people’s personal information outside the country should safety assessment of data. Where data does not contain personal information or important data, there is no need to declare a security review assessment, according to Reuters.

- Chinese FX Regulator expects the current account surplus to remain basically stable in H2 and said the cross-border two-way investment is expected to further stabilise and improve. The scale of FX reserves will remain basically stable. Will actively fend off and resolve external shock risks. Will strive to maintain the stability of FX markets and balance of payments.

- Chinese Finance Ministry will exempt urban land use tax on land used for construction of affordable housing projects. Stamp duty for affordable housing management firms and buyers are exempted. Tax exemptions and cuts effective from October 1st, according to Reuters.

DATA RECAP

- Australian Retail Sales MM (Aug F) 0.2% vs. Exp. 0.3% (Prev. 0.5%)

- New Zealand ANZ Business Confidence (Sep) 1.5 (Prev. -3.7)

- New Zealand ANZ Activity Outlook (Sep) 10.9 (Prev. 11.2)

Loading…

https://www.zerohedge.com/markets/equities-indecisive-dxy-fixed-weaker-us-ijc-gdp-final-nike-earnings-due-newsquawk-us-market