By Russell Clark, author of the Capital Flows and Asset Markets substack

I have been fascinated by “volatility” markets for years.

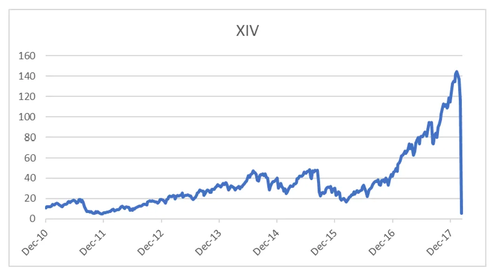

Products that sell volatility to generate yield (or converting the premium you receive from selling volatility into a form of fixed income) – autocallables – have been an interest for me for years. Over the years we have seen various blow-ups in the volatlity markets – HSCEI in 2015/6, KOSPI in 2019. Back in GFC, Japanese autocallable products, particularly in currency markets proved to be totally disastrous. Most investors should remember the overnight implosion of XIV, a short VIX ETF, in 2018.

One of the things that I started to look at was trying to work out when volatility is “mispriced”.

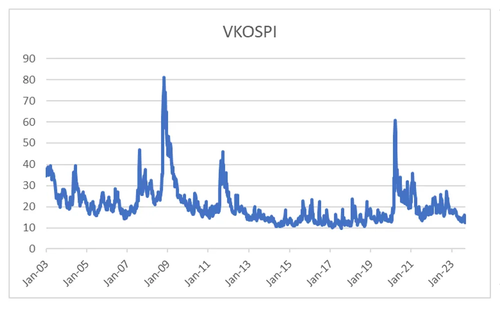

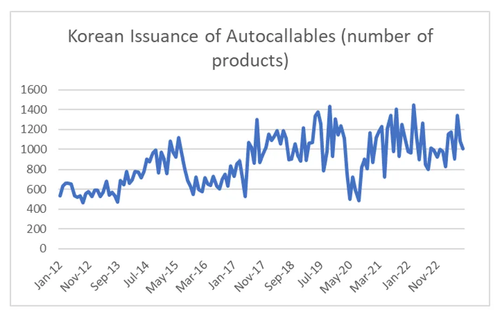

That is when in my view that volatility selling products had pushed volatility to unsustainable low levels. One of my favorite examples of this was Korea, which in recent years has become the single biggest market for equity autocallable products. From 2003 to 2012, VKOPSI (VIX for KOSPI 200) rarely traded below 20. From 2012 onwards it rarely traded above 20, until we hit Covid and 2022 tech sell off – but here today we are trading back at close to record lows.

I noted that the collapse in Kospi volatility coincided with the sharp increase in Korean issuance of autocallables.

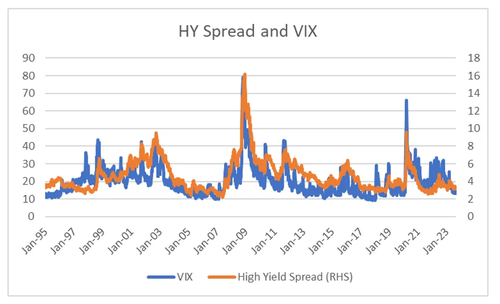

I started to think that the tail was wagging the dog. Looking at the way clearinghouses prices risk, I could see a world where momentum strategies would drive volatility lower and markets higher, and then cause a massive unwind. In many ways, what we saw in the GFC. The problem with the view was that governments now take a very dim view of financial instability. When I look at VIX, and compare it to high yield spreads, another measure of financial risk, the correlation is very high, and with no real change in the relationship since 1995, despite the rise of volatility selling.

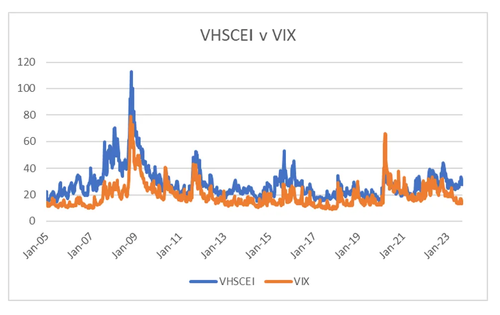

The big difference to the 1990s, or even the 2000s, is that governments are extremely pro-active in stabilising markets. The Federal Reserve guaranteed high yield bonds during Covid, and governments have a “spend what it takes” attitude to economic growth. US and China are taking divergent view on markets. The US seems more comfortable with doing whatever it takes to keep markets growing, while China wants lower property prices, and is happy to see property developers go bankrupt to achieve that end. Due to this political divergence, see that the correlations between VHSCEI (China) and VIX (US) is weakening. In 2015, the move higher in VHSCEI was driven my currency devaluation fears, but the recent move higher is more politically driven in my view.

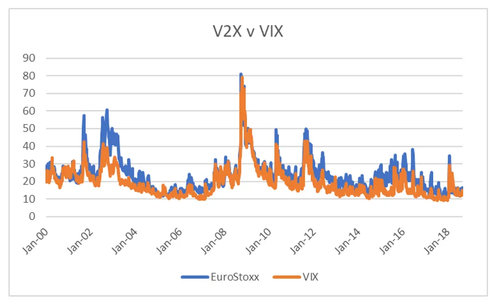

So post GFC, volatility markets, as they are tied to credit markets which represent the willingness of governments to backstop those markets. From that perspective, Europe has much more closely followed the US.

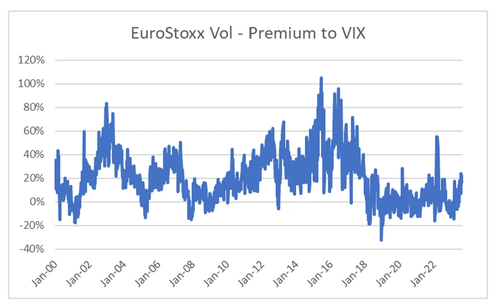

The relative volatility of EuroStoxx 50 also matches up with the political changes in Europe. From 2011 onwards, there was more political risk in European markets than in the US. Even though the ECB acted to stabilise markets, there was no political agreement. With Covid, and more united approach to Europe by European governments has appeared, the premium of European vol to US vol has collapsed. From an economic point of view, the war in Ukraine should lead to Eurostoxx Vol trading at a premium, but politically, the collapsing vol premium makes sense.

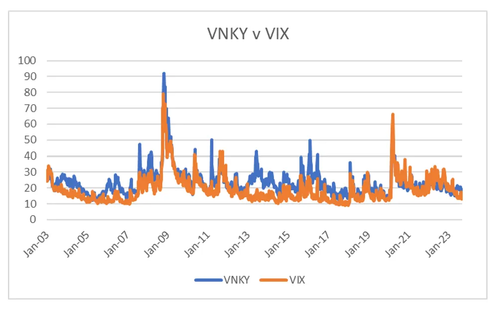

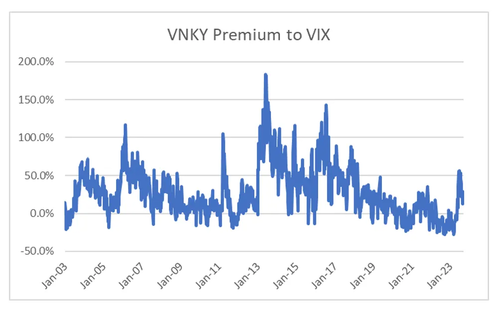

So for volatility traders, what does this analysis mean? Well the low levels in the US, Korea and Europe accurately reflect government attitudes towards markets. While Biden talks up taking on big corporates, with an election year coming up, strong stock markets are probably better for him. One market where problems of income inequality and over powerful corporates is not an issue is Japan. Here both government and central bank policy is still pro-capital. From this perspective, I could almost argue that VNKY should trade inside VIX, which in recent years it has started to do, this in sharp contrast to the trend from 2003 to 2019.

Recently VNKY has spiked over VIX, so for volatility traders, a short VNKY perhaps hedged with a long VIX looks interesting.

Politics trumps economics is the lesson I have learnt the hard way. Politically it feels there is less political risk in Japan, so this premium in VNKY look like an opportunity. However, this view is based on a political judgement, which means it could change quickly if politics changes.

Loading…

https://www.zerohedge.com/markets/new-way-think-about-equity-volatility