By Peter Tchir of Academy Securities

While we are engaged in discussions on “sticky” inflation and long/variable lags, etc., the “real” story is likely real yields.

For reference, I’ve used the Federal Reserve Real Yields. There are various other “real yield” calculations out there, but they all tell similar stories. I chose the 5-year partly because it was the most dramatic (with inverted yield curves, the 10-year real yield is lower), and also because 5 years seems like a reasonable timeframe to think about.

The last time the 5-year real yield was above 2% for an extended period of time was in 2006 and early 2007. We all know what happened after that.

While a 2% real yield is great for savers, it may place an increasingly difficult burden on borrowers and growth. New projects need to meet a considerably higher hurdle rate to warrant funding those projects.

Inflation Expectations Seem “Reasonable”

I don’t like to think about real yields “in isolation.” We already know nominal yields are between 4.25% and 5% depending on where you are on the curve. But I want to keep an eye on inflation expectations (mainly because the Fed pays attention to this data).

The average for this metric is 2.8%. Yes, we are at 3%, but that is barely above the average. In almost 25 years, this measure has NEVER hit 2%.

We can debate until we are blue in the face about whether 2% is a realistic target or not. Powell says that it is their target, but I suspect that anything sub 3% on inflation allows him to be “patient” on hiking.

In any case, high real yields are becoming a potential issue for the economy and that is not being accompanied by a big shift in future inflation expectations.

5-Year, 5-Year Forward Breakeven Yield

Let’s be honest, I only use this because saying anything as complicated as “5-year, 5-year forward breakeven yield” must make me sound smart. If I think really hard about it, I can understand what it actually means, and I know that others (including the Fed) are keeping an eye on this.

We are hovering right around the long-term average, which seems like a decent place to be. We’ve been bouncing around this level for months now. I’m not exactly sure about the significance of this (it is low on my “radar” screen) and it doesn’t seem to be setting off any alarm bells about inflation, rates, or the shape of the curve.

From my perspective, this fits my current view of the Fed quite well:

- High hurdle to hike.

- Incredibly high hurdle to cut.

But I’m digressing from the real yield discussion and the potential impact on the economy.

Borrowing Costs

We all know that credit spreads have done well (at least for investment grade and high yield bonds). This is less so for leveraged loans, but even there we see a decent bid and if we get a short squeeze rally in credit, it will start with the lev loan/CLO market.

But what about smaller issuers or those who we don’t see every day (or possibly ever)? We already have a stock market that focuses on the “Magnificent Seven,” but have we thought enough about what is occurring as you move to smaller companies, especially on the borrowing side?

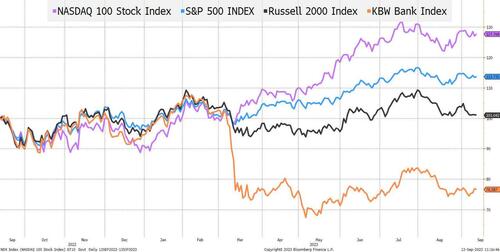

We’ve discussed these relative performance charts multiple times this year, but now I want to think about them from a different angle. What do we think is happening to companies smaller than those included in the Russell 2000 (i.e., small private companies)?

The two relevant indices are:

- The Russell 2000. Basically, flat this year, but underperforming the Nasdaq 100 by 27% and the S&P 500 by 12%. How much would even smaller companies be underperforming by? If the Russell 2000 companies can only break even, what does it say about the state of smaller companies as a whole? I presume nothing good.

- The KBW Bank Index is also important as it reflects the performance of banks, which are in turn the preferred supplier of credit for smaller companies. While large companies rely on banks, it is more often than not for revolvers that are unlikely to be drawn. For smaller companies, bank loans are a primary source of borrowing. How do they get those loans when the banks themselves are under pressure? Bank deposits are back to declining (and are shifting from smaller banks into larger banks).

I don’t know what the borrowing opportunities are for smaller companies, but I suspect that they aren’t great given the data that we have and where it seems to be pointing. One counterargument I’ve heard is that the Russell 2000 has many banks and that is part of the underperformance, but that doesn’t explain the “Magnificent Seven” and the divergences between equal weighted and market cap weighted indices.

Small Businesses

Academy’s client base is predominantly large corporations. It is great that these companies are chugging along (I’m currently bullish stocks and credit spreads). Having said that, it is best when the economy is firing on all cylinders!

In this report we started with facts (real yields are historically high), but we have waded into conjecture (small companies are under pressure).

My friend, Joe Brusuelas, who I think has a great take on the small and mid-sized company economy, published this Commentary in Barron’s. In this report he points out that according to their survey of “middle market businesses,” about 35% of them are going to the shadow market and getting rates averaging 13.7%.

IG yields are around 5.75% and HY yields are around 8.5%. 13.7% seems to be in the realm of CCC borrowers.

I take this seriously, partly because it is important to the economy, but also because it tends to be important to politicians.

One thing that the troubles surrounding Silicon Valley Bank (for example) showed me is how connected politicians are to their local banks and businesses. We saw lots of politicians discuss the messages that they were getting from the banks in their districts. While the Fed learned from the GFC to act early and aggressively and to never let problems spread within the banking system, the level of political support helped them act as well.

So, when I start hearing that those most connected to small businesses are advocating for a pause, I suspect that there is a big and powerful movement behind it.

Basically, new to my list, is the likelihood that there is a powerful lobby in the works to send a clear message to D.C. that the rate hikes are hurting these small businesses. While the Fed is apolitical, the arguments seem economic which should sway the Fed. From a market standpoint, if politicians and the media start focusing on some of this risk, I think that we will price in fewer hikes, which should help yields and the broader market.

CRE Too

One client in particular has argued profusely (and I completely agree with them) that the Fed pays extreme attention to CRE. The argument is that the Fed can ignore problems in the high yield market because it is a niche market. As big as it is, it is understood to be risky and is small relative to U.S. GDP.

Regarding IG, they can tolerate larger moves in spreads because these companies are good and have a lot of runway and the ability to manage any spread widening. In addition, similar to COVID, if it gets bad enough the government will intervene, but they don’t need to worry unless the spread widening and dislocations become severe.

CRE is a different animal. It is a simply massive market. It is also generally viewed as safe (one condition that I watch closely for contagion or bubble risk) and in many cases, the loans are held in the banking system (another thing that I watch closely for contagion risk).

While CRE will not be “bailed out” by the Fed or D.C., they have absolutely zero incentive to push it over the edge. We’ve made it this far in the fight with inflation and haven’t toppled CRE (most indices have bounced significantly since their late April lows, but are far from the highs before the Fed started hiking into a WFH environment).

It would seem prudent for the Fed to give this sector an opportunity to work itself out, i.e., to refinance, restructure, and to take losses where needed (but not push it too far).

Bottom Line

While a lot of the data we get may point to inflation (and I continue to expect economic data to show slowing), there is a lot more for the Fed to worry about behind the scenes. CRE might seem obvious, but a lot is private and not marked to market, so the Fed has to feel its way around. Small businesses (and their borrowing) are another example of an area where we don’t get a report the first Friday of every month, but it is potentially equally important to the Fed.

If anything, I’m tempted to change my view on the Fed to one where it takes an incredibly high hurdle to hike or to cut.

Somehow, I started with “real yields” and wound up with “middle market businesses and commercial real estate,” but it is all part of the same story and one that the Fed needs to watch closely.

Loading…

https://www.zerohedge.com/markets/real-story-real-yields