Quite a week… sticky (or rising) inflation, mostly bad picture of the labor market, and sentiment softens – not exactly the goldilocks/soft-landing that The Fed and most of the talking heads keep dreaming of and in fact more stagflationary signals evident.

‘Hard’ data disappointed this week and fell to 4 month lows while ‘soft’ survey data surged back near cycle highs on the heels of hope…

Source: Bloomberg

Overall on the week, STIRs pushed dovishly lower…

Source: Bloomberg

That dovish tilt supported stocks all week – even with today’s post-payrolls weakness – for big gains in Nasdaq and Small Caps (best week since March)…

The kneejerk reaction to payrolls was higher in stocks but as soon as the cash market opened, The Dow, S&P, and Nasdaq were hit by selling (higher rates, lower stocks) but the last hour saw a 0-DTE covering-driven bounce back into the green for all but Nasdaq…

And all on the back of the biggest weekly short-squeeze since January (‘most shorted’ stock up almost 7%)…

Source: Bloomberg

For the 3rd day in a row, NVDA was unable to break above its $500 Call-Wall level…

Staples and Utes ended lower on the week while Tech, Materials, and Energy led the gains…

Source: Bloomberg

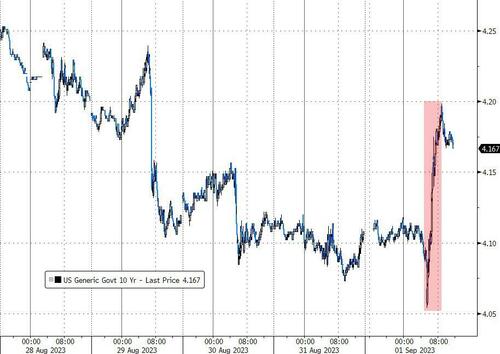

Treasury yields exploded higher today after the payrolls data to wreck the week’s trend and push the long-end higher on the week (30Y +1bps, 2Y -21bps)…

Source: Bloomberg

Which steepened the yield curve (2s30s) dramatically – up near recent highs. The 2s30s curve has risen for 5 straight sessions…

Source: Bloomberg

But, it is worth pointing out today’s huge jump in yields (despite the broad weakness in jobs data) after a kneejerk lower (that’s a 15bps spike in 10Y yields)…

Source: Bloomberg

Here are 10 possible reasons for the surge in yields (via Bloomberg)…

-

Hollywood strikes and Yellow Corp. bankruptcy cut 54,000 from August jobs. Without that, non-farm payrolls would have been closer to ~240,000

-

Debunking the decline in August average hourly earnings, noting it might be temporary. Companies still plan to hike wages. A special question in Monday’s Dallas Fed Manufacturing report showed companies expect to raise wages by 5% this year. That’s above the level of inflation and something that can keep the consumer spending — putting a floor under inflation

-

The slight rise in hours worked in August gives credence to Thursday’s Chicago PMI report whereby there were glimmers that business activity is getting back on track after a soft patch

-

US August ISM Manufacturing index saw rises in the overall index, production, backlogs, lead times, prices paid and employment

-

Money managers sold the long end and fast money did steepeners in swaps. Traders are short and letting those winning positions ride

-

Mortgage origination has picked up. It’s $800 million so far today, that’s up from its typical $500 million pace

-

Preparations for an onslaught of corporate supply

-

Breakout in crude oil as OPEC+ supply cuts tighten market. Option bets on $100 oil are also rising as supplies tighten

-

Saudi Arabia Aramco is considering selling $50 billion in shares. It would be advantageous for the Kingdom to keep oil supplies tighter thus prices higher through the offering

-

Federal Reserve Bank of Cleveland President Loretta Mester said inflation remains too high despite recent improvements, and the labor market is still strong

The dollar ended the week marginally higher after exploding back to Tuesday’s PCE highs and Friday’s Jackson Hole highs…

Source: Bloomberg

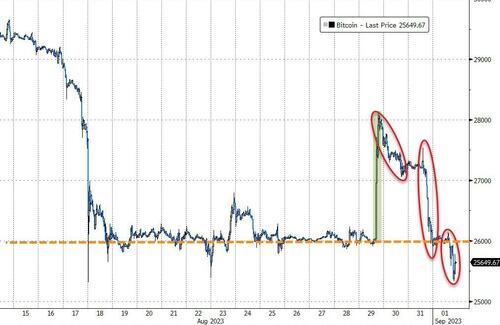

Crypto had an ugly week, legging lower again today as the dollar spiked, with Bitcoin back below $26,000. After three weeks hugging 26k, we spiked on the SEC losing but then three selling legs wiped all that lipstick off the pig…

Source: Bloomberg

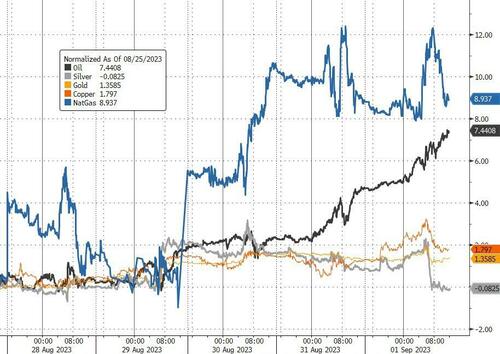

Energy dominated in commodity-land this week (led by NatGas) while silver was flat and Spot Gold improved…

Source: Bloomberg

WTI soared to its biggest week since March, reaching akmosty $86, the highest since Nov 2022…

Source: Bloomberg

Gold (spot) rallied for the second week in a row, topping $1950 back at one-month highs…

Source: Bloomberg

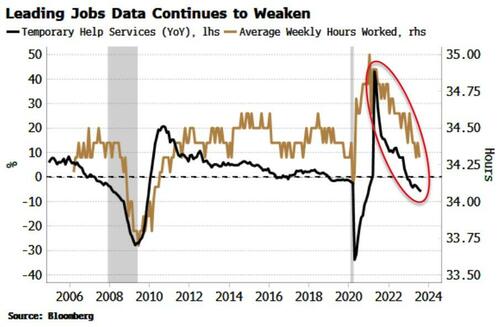

Finally, while many continue to grasp the ‘soft-landing’ straw narrative, we note that despite the headline payrolls number surprising slightly to the upside, temporary help and weekly hours worked continue to point to a weakening jobs market, consistent with a drop in yields…

Source: Bloomberg

Employers typically cut hours worked and temporary staff before they lay off full-time employees. The data suggests that underlying pressures are building, and job losses should start to rise more rapidly in the coming months.

This is consistent with the message from other leading indicators, such as higher claims and tighter consumer credit conditions.

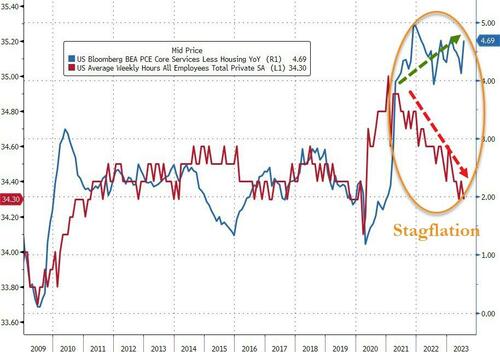

And at the same time, ‘core services’ inflation jumped to its second highest since 1985…

Source: Bloomberg

…and Manufacturing ISMs confirmed the stagflationary theme.

Loading…

https://www.zerohedge.com/markets/biggest-weekly-short-squeeze-jan-lifts-stocks-crude-jumps-crypto-dumps