Authored by Simon White, Bloomberg macro strategist,

There continues to be compelling signs that a US recession could be near at hand, a risk that stock markets are not reflecting.

This week we get a raft of US data that will shed further light on US recession risks. While some data points, such as the Atlanta Fed’s GDPNow growth estimate, are consistent with a robust economy, there are several other data points that continue to imply a recession is close (or not implausibly, even here now, if data is subsequently revised lower).

The Four P’s of recessions is that they are downturns that are persistent, protracted, pervasive and precipitate.

To capture these, I created the Recession Gauge, which is made up of 14 sub-components that cover a wide array of market and economic data. It has been in recession mode all of this year.

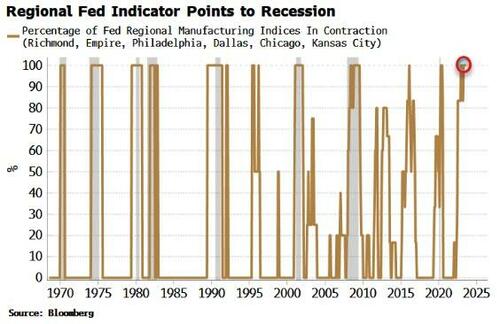

One of its sub-components is the Fed Regional Manufacturing Indicator (we’ll get one of its data points today with the Dallas Fed’s Manufacturing Index for August). The Fed regional banks’ indexes are notoriously volatile, however if we look at the percentage of them contracting, it gives a historically reliable foreshadowing of a recession, having only two false positives going back to 1970. The indicator is currently in recession mode.

This week we will also get claims, payrolls and ISM data.

Claims data by US state continues to be consistent with a near-term recession. ISM manufacturing remains in contraction territory. The new orders-to-inventory component is rising, pointing to some near-term upside for the headline index, but recent PMI data disappointed to the downside, intimating that the manufacturing recession is ongoing.

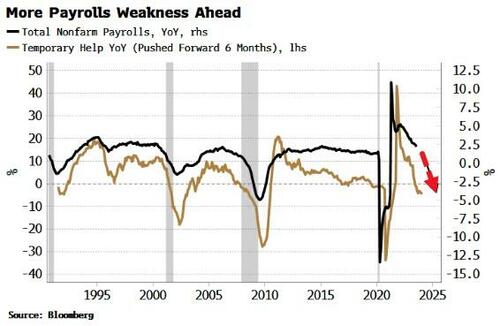

The labor market has been the most unexpectedly resilient part of the economy through the Fed’s hiking campaign. But weakness is becoming more apparent. Not only is, for example, payrolls data being revised lower (as is typical at turning points), leading jobs data shows payrolls growth should keep falling, and the unemployment rate soon start rising.

Employers tend to reduce employee hours and let temporary workers go before they start layoffs. Average hours worked has been falling, and growth in temporary-help employment has been contracting, pointing to much weaker growth in payrolls.

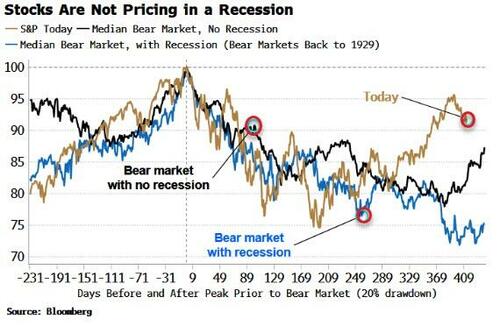

Stocks have been dancing to a different tune, however. Their path since the bear market began last year has not only exceeded previous bear markets that coincided with a recession, but is now clearly ahead of all prior bear markets going back to 1929.

Even though in this downturn – as one likely to be accompanied by high inflation – stocks are less likely to fare as badly (in nominal terms), they are still prone to a rude awakening from an economy that could precipitately look very recession-like.

Loading…

https://www.zerohedge.com/markets/us-stocks-are-underpricing-recession-risks