Two weeks after Moody’s slashed ratings of regional banks on a ‘triple whammy of factors’, now S&P Global Ratings is joining the downgrade party. S&P is painting a grim picture for even more lenders due to higher interest rates and deposit outflows, according to Bloomberg.

S&P wrote in a research note that a “tough” lending environment forced them to downgrade five banks – KeyCorp, Comerica Inc., Valley National Bancorp, UMB Financial Corp., and Associated Banc-Corp, one notch citing negative outlooks for River City Bank and S&T Bank. The rating agency said the review of Zions Bancorp remains negative.

The reason for the downgrades is because depositors have “shifted their funds into higher-interest-bearing accounts, increasing banks’ funding costs,” S&P said, adding, “The decline in deposits has squeezed liquidity for many banks while the value of their securities – which make up a large part of their liquidity – has fallen.”

S&P’s downgrades come two weeks after Moody’s slashed the ratings on ten small and midsize banks. It cited higher funding costs, potential regulatory capital weaknesses, and rising risks tied to commercial real estate loans as the reasons for the downgrade.

“US banks continue to contend with interest rate and asset-liability management risks with implications for liquidity and capital, as the wind-down of unconventional monetary policy drains system-wide deposits and higher interest rates depress the value of fixed-rate assets,” Moody’s analysts Jill Cetina and Ana Arsov said in the accompanying research note.

Moody’s also warned there is more pain ahead:

“We continue to expect a mild recession in early 2024, and given the funding strains on the US banking sector, there will likely be a tightening of credit conditions and rising loan losses for US banks.”

Earlier this month, Fitch Ratings downgraded the US government’s top credit rating. Last week, Fitch analyst Chris Wolfe told CNBC another round of turmoil could be nearing for the banking industry. He said the ratings agency is mulling over sweeping rating downgrades for dozens of banks, including ones as big as JPMorgan Chase.

The KBW Bank Index of major US banks remains at March levels when several regional banks failed.

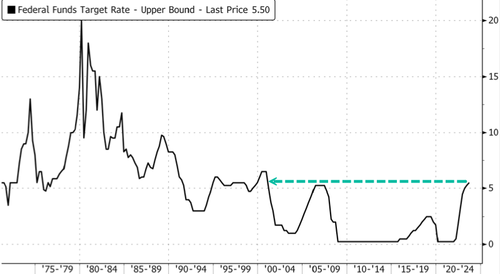

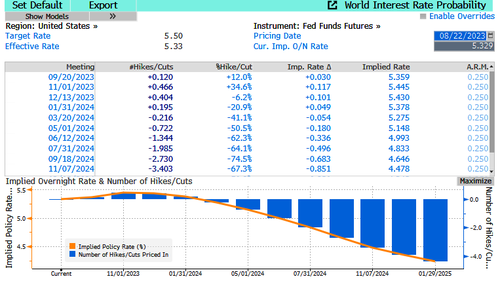

Banking turmoil comes as the Federal Reserve has hiked interest rates to 22-year highs.

Rates on swap contracts referencing future Fed policy meetings suggest the target rate of 550bps could be the terminal rate. We suspect the full impact of the tightening cycle has yet to arrive (but it will).

“While many measures of asset quality still look benign, higher rates are pressuring borrowers,” S&P wrote.

It also warned:

“Banks with material exposures to commercial real estate, especially in office loans, could see some of the greatest strains.”

The dominos are already falling in specific CRE markets.

Loading…

https://www.zerohedge.com/markets/sp-joins-downgrade-party-us-banks-due-tough-cliamte