Despite its recommitment to core business fundamentals in the last few years, WeWork’s management – which saw a shakeup in May 2023 when CEO Sandeep Mathrani departed – is setting off a signal flare about the company’s future.

“Our losses and negative cash flows from operating activities raise substantial doubt about our ability to continue as a going concern.”

– WEWORK, SEC FILING, AUGUST 8TH, 2023.

But how did the once-poster child of Silicon Valley end up seeing its valuation collapse more than 99% from its peak?

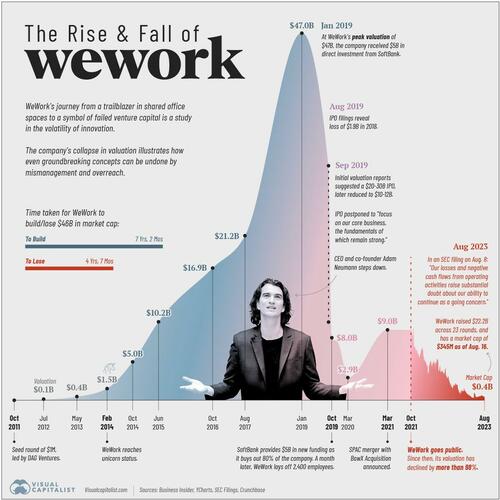

Pulling together data from various sources, Visual Capitalist’s Pallavi Rao charts the rise and fall of WeWork since 2011.

Things went just a little bit more turbo for the office-space-provider as it plunged as much as 18% this morning after announcing a 1-for-40 reverse stock split to regain compliance with listing requirements.

“The reverse stock split is being effected primarily to increase the Company’s per share trading price and to regain compliance with the $1.00 per share minimum closing price required to maintain continued listing on the New York Stock Exchange,” the release says.

The Rise of WeWork: 2010–2019

WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey with the primary objective of providing shared workspaces catered to freelancers, startups, and companies seeking “flexible office solutions.”

The business model, which rested on renting space from developers long-term, renovating and parceling the property, and subsequently leasing it out to short-term clients, thrived in a decade of low interest rates.

Its valuation surpassed $1 billion in 2014, earning the coveted “unicorn” status. In 2017, SoftBank Group made the first of its total $18.5 billion investment in the company. Two years later, WeWork hit a peak valuation of $47 billion with SoftBank’s continued investments, raising expectations for an imminent IPO.

Footnote: *SoftBank valuation is based on discounted cash flow method.

The Fall of WeWork: 2019–2023

Intensive scrutiny fueled by the impending IPO raised several questions for the company. These included concerns around Neumann’s leadership style, excessive spending, creative accounting, and conflicts of interest leading to Neumann’s resignation and delay of the IPO.

In October 2019, SoftBank Group acquired 80% of the company with $5 billion of additional funding. A month later WeWork laid off 2,400 employees, nearly one-fifth of its workforce.

Real estate veteran Sandeep Mathrani was made CEO in 2020, tasked with turning the company around by eliminating recurring costs and restructuring its debt.

That same year the COVID-19 pandemic forced a significant shift to remote work, causing a decline in office space demand. WeWork’s business model, focused on shared physical spaces, faced a substantial challenge.

In 2021, WeWork went public through a SPAC merger, aiming to regain investor trust. The listing reflected a revised strategy focusing on key markets, cost optimization, and a pivot toward catering to larger corporate clients with hybrid work needs.

Over the past two years, its market capitalization as a publicly-traded company has plummeted from $9 billion to under half a billion dollars. WeWork disclosed $11.4 billion in net losses from 2020 through to June 30th, 2023 in their recent SEC filing.

What Happened to WeWork?

Aside from the trials and tribulations of former CEO Adam Neumann, the company’s sustainability itself has been questioned several times over the past decade. In 2019, the Guardian summarized the criticism succinctly by saying, the company was “renting long and subleasing short,” which left it “exposed to risk.”

Post-pandemic, the proliferation of work-from-home policies, along with the rapid rise in global interest rates in the last year—which can reduce cash flows for the commercial real estate industry—have magnified those risks.

WeWork is now battling an environment of excess supply, softer demand, increased competition and macroeconomic volatility, according to interim CEO David Tolley.

“It was foolish of me to invest in WeWork. I was wrong.”

— MASAYOSHI SON, SOFTBANK GROUP FOUNDER.

The New York Times says that WeWork has more than 18 million square feet of rentable office space in the U.S. and Canada alone and that its failure could have a “sizable impact” on the commercial real estate industry.

At the same time, the Times notes that reporting the “substantial doubt” on continued business operations might help the company buy time with lenders to seek additional capital through issuance of debt, equity, or the sale of assets.

Loading…

https://www.zerohedge.com/markets/visualizing-rise-fall-wework