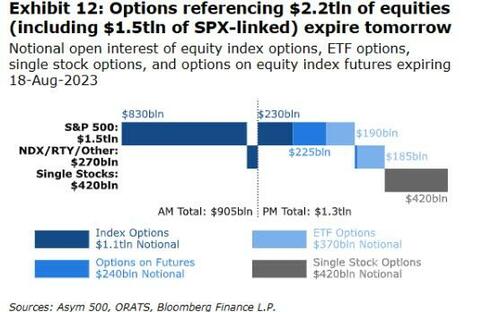

Today’s option expiration comes at the end of the worst week for US equities since the collapse of SVB triggered a mini-crisis. According to former Goldman options guru Rocky Fishman, founder of derivatives analytical firm Asym 500, some $2.2 trillion of longer-dated contracts tied to stocks and indexes are scheduled to expire today.

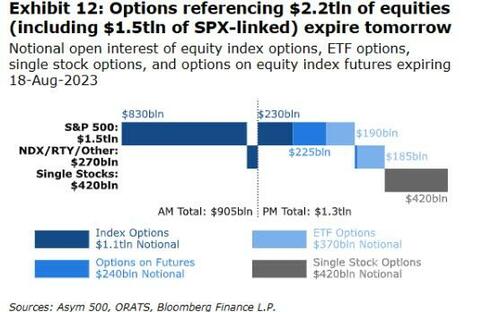

Given the recent, rather aggressive moves lower in the major US indices, today’s Options Expiration has shifted from a neutral expiration to one which is more put weighted (blue bars = puts, below).

Loading…

https://www.zerohedge.com/markets/put-call-ratio-roars-record-high-ahead-2-trillion-negative-gamma-opex