While other hedge fund managers have been forced to unwind their shorts as the market rallied this summer, it looks like Ray Dalio may have timed the peak of 2023’s market perfectly.

Bridgewater Associates’ flagship fund was bearish on U.S. stocks at the same time the rally in U.S. stocks finally topped at the end of July, a new report from Reuters today revealed.

The revelation was made in a July 25 investor briefing that was seen by Reuters. In it, it discloses that the company’s “Pure Alpha” fund had a bearish view on markets heading into August, where stocks have fallen about 3%.

The report also noted that Ray Dalio was “moderately” bearish on U.S. Treasuries, in addition to stocks. Bridgewater, known as a secretive fund that doesn’t always provide robust details about its market positioning, didn’t comment to Reuters about its presentation to investors. Sources familiar with the matter said the presentation to investors was given online.

The fund was bearish on the U.S. dollar, metals and global equities, the report says. It had “bearish positioning in 15 of the 28 assets it analyzed” and its top two bullish bets were the Euro and the Singapore dollar.

The fund was “moderately positive” on the Mexican peso and inflation-linked bonds, Reuters said.

Bridgewater’s co-chief investment officer Greg Jensen said on an early August podcast posted to the firm’s website that “liquidity in the U.S. government bond market was getting worse, as the Treasury increases bond issuance”. He predicted this would lead to lower asset prices.

We wrote extensively throughout the summer that many hedge funds who were positioned short earlier this year were being forced to unwind their bets, likely helping perpetuate the squeeze higher during the summer’s early months. The S&P is up 15.6% so far this year and the NASDAQ is up nearly 30%.

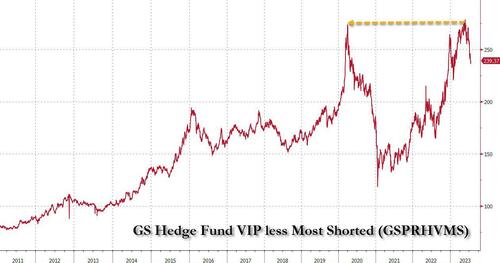

Back in late July we pointed out that an index that is a proxy of hedge fund exposure (long the hedge fund VIP basket of companies and short the most popular shorts) had just suffered staggering losses after reaching a level that was identical to the pre-Covid crash.

This was coming at a time when, contrary to what one would assume is pervasive euphoria as a result of the surge in the S&P, L/S managers “had experienced 9 consecutive days of negative alpha, the longest period since Jan 2017” and July was on course “to be the worst month in terms of alpha since May last year”

A week and half after our assessment, Bloomberg caught up and echoed our cautionary assessment almost verbatim in “Hedge Funds ‘Throwing In Towel’ on Stocks as Rally Forces Unwind”.

We also noted that billionaire hedge funder Dan Loeb slashed the size of single name shorts to limit the vulnerability of his hedge fund, Third Point, to short squeezes, he said in a letter earlier this month. We asked two weeks ago:

By covering his shorts, Loeb has managed to avoid most of the pain that is now ravaging his fellow “2 and 20” buddies. The question is will the rest of the hedge fund space now follow, in the process making the short squeeze far, far worse (the illiquid late summer environment is hardly the best time for wholesale short covering), or will a drop in the market and the most shorted names – ironically – prevent a market crash?

With the S&P and NASDAQ are 3.4% and 5.2% off of their highs this year, according to Reuters, it looks like we might have our answer. And it appears Dalio’s fund could be positioned perfectly to watch it all come crashing down.

Bridgewater’s Pure Alpha 12% volatility fund was up 2.5% for the year, the report says, and its Defensive Alpha fund was up 2.1%.

Loading…

https://www.zerohedge.com/markets/bridgewaters-flagship-fund-was-bearish-market-peaked-late-july