Authored by Simon White, Bloomberg macro strategist,

The main data story overnight was China CPI slipping into deflation.

But the market’s reaction was a bit of a yawn.

If you’re a proponent of the “China is becoming Japan” story, then that would have merited a reaction like Tuesday’s after the trade data, i.e. lower yields and commodity prices.

But not today.

Here are three possible reasons.

Firstly, the market is looking ahead, perhaps believing the deflation will be short-lived. PPI rose (although by less than expected), while commodity-related headlines such as this from today – *RICE IN ASIA SOARS TO HIGHEST LEVEL SINCE 2008 ON SUPPLY RISKS – flash up, and are becoming more common. As a reminder, inflation is one of the most lagging economic variables.

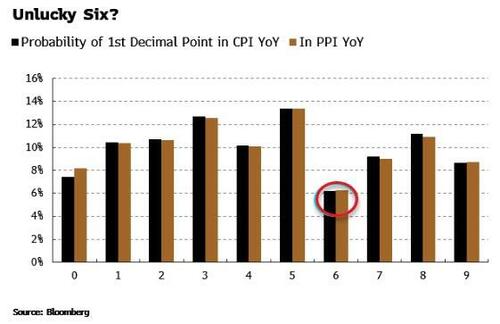

A second reason for the market’s indifference is perhaps it doesn’t 100% trust economic statistics from China (even when they are negative). I ran a quick frequency distribution of the first decimal point of the full history of the year-on-year CPI and PPI data (about 30 years’ worth of monthly data).

If it was completely random, each digit should appear about 10% of the time. That’s actually largely what we see. The only quirk is a low frequency of sixes in the data, which is ironic as six is supposed to be a lucky number in China. Anyway, there is no real smoking gun of significant manipulation, but perhaps the market still retains some lingering skepticism for the veracity of the country’s economic data.

(In the interests of fairness, I did the same analysis with US CPI data and it is much more evenly distributed, i.e. more random.)

The third possible reason for the muted asset reaction is that, despite the deflationary signs from the data, excess liquidity (real money growth less economic growth) in China is rising. If excess liquidity is swilling through the economy it makes it harder for risk assets to sell off too much. Excess liquidity’s rise is consistent with the nascent recovery we are seeing in China’s stock market.

It’s quiet on the data front today, and barring any exogenous events it should remain that way ahead of US CPI tomorrow.

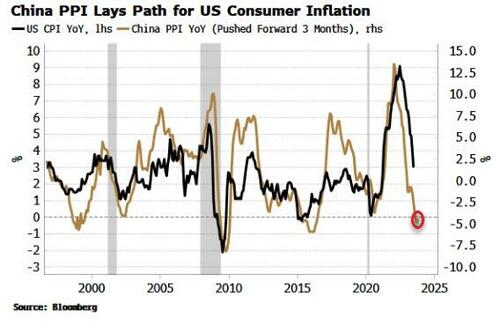

If the disinflationary trend in China’s PPI continues (mounting stimulus is likely to support this), then this will have an upside influence on US CPI in the coming months.

Loading…

https://www.zerohedge.com/markets/chinas-deflation-yesterdays-news