By Megan Brenan of Gallup

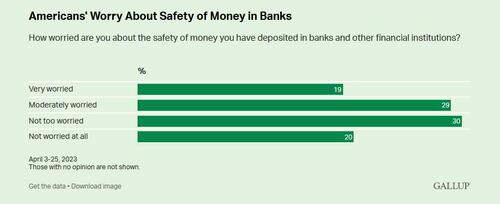

Amid turbulence in the U.S. banking system, nearly half of Americans are anxious about the safety of the money they have in accounts at banks or other financial institutions. A total of 48% of U.S. adults say they are concerned about their money, including 19% who are “very” and 29% who are “moderately” worried. At the same time, 30% are “not too worried” and 20% are “not worried at all.”

These findings are from a Gallup poll conducted April 3-25, the month after Silicon Valley Bank and Signature Bank collapsed. News about the failure of a third bank — First Republic — came after the poll was completed. Most bank failures in the U.S. over the past two decades have been linked to the 2008 financial crisis, which was the last time Gallup gauged Americans’ level of worry about their money held in banks or other financial institutions.

The latest readings are similar to those in 2008. In September of that year, shortly after the collapse of Lehman Brothers, which remains the largest bankruptcy filing in U.S. history, 45% of U.S. adults said they were very or moderately worried about the safety of their money. Several months later, in December, after Congress’ Troubled Assets Relief Program (TARP) bailed out other banks in danger of failing, Americans were slightly less concerned about the safety of their personal financial accounts, as 41% said they were very or moderately worried.

Worry About Banks Higher Among Republicans and Independents

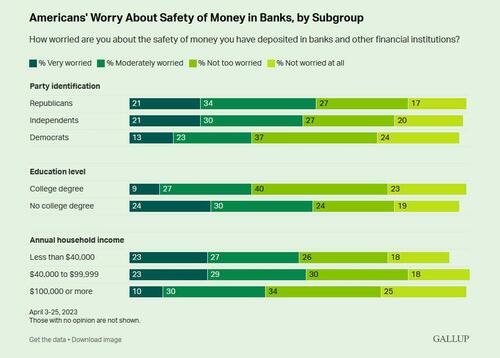

Republicans, independents, middle- and lower-income adults, and those without a college degree are more worried than their counterparts about the safety of their money.

Whereas majorities of Republicans (55%) and independents (51%) say they are at least moderately worried, a 36% minority of Democrats are. Similarly, 54% of U.S. adults with no college degree are very or moderately worried, while 36% of college graduates are. About half of Americans with an annual household income under $100,000 express worry about their money, while 40% of those with higher incomes do.

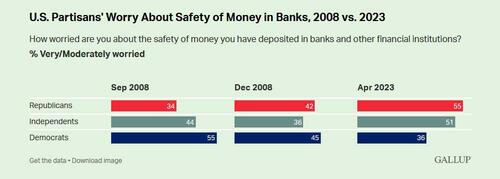

Partisans’ levels of worry about the safety of their money in the banking system also diverged in September 2008, but in the opposite way. Republican President George W. Bush was in the White House when the financial crisis unfolded, and the views by party were nearly the reverse of those today. At that time, 55% of Democrats were very or moderately worried versus 34% of Republicans.

Another indication that partisanship is a significant driver of opinion on this question is that after the government bailout in 2008 and Barack Obama’s election win against John McCain, Democrats’ and independents’ levels of worry dropped, while Republicans’ rose eight percentage points.

While there weren’t differences by education level in September 2008, worry among lower- and middle-income adults was higher than that among higher-income adults.

Bottom Line

After several recent high-profile bank failures in the U.S., about half of Americans are concerned about the safety of the money they have in banks or other financial institutions. This is on par with the level of worry measured during the financial crisis in 2008 when financial institutions previously believed to be “too big to fail” collapsed. And while Gallup has not measured this during calmer times for the banking industry, the December 2008 reading showed slightly diminished concern after the crisis had been addressed, suggesting high worry about the security of deposits may not be the norm for Americans.

When banks fail, it is also unclear whether Americans’ heightened concern about their own deposits reflects a lack of awareness of the protections for small accounts provided by federal deposit insurance or their fear of a snowball effect that could bring down federal insurance as well. The Federal Deposit Insurance Corporation (FDIC), a U.S. federal government agency, insures $250,000 per depositor, per insured bank, for each account ownership category. Yet, lower-income adults, those without a college degree and Republicans are more worried than their counterparts. Worry among these groups may be higher because they do not know about FDIC insurance, or it may be linked to their displeasure with the current presidential administration and the U.S. economic situation.

Loading…

https://www.zerohedge.com/markets/48-americans-are-worried-about-their-moneys-safety-us-banks-more-during-peak-2008-crisis