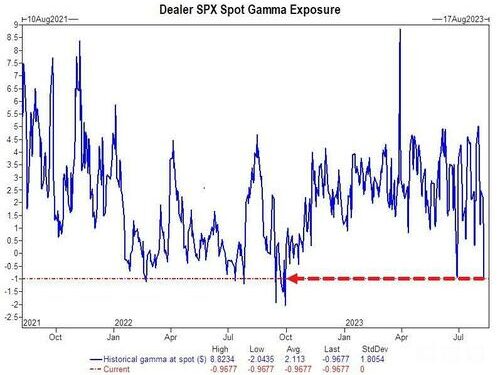

Yesterday morning, just as stocks exploded higher in the aftermath of the dovish CPI print, we reported that dealer gamma had turned ominously negative (which in turned followed SpotGamma’s warning that “the clock is ticking on negative market gamma”), which prompted Goldman’s derivative guru Scott Rubner to correctly urge clients to “sell the CPI bounce”, a call which proved prophetic in light of the sharp intraday reversal that pulled stocks in the red after spiking more than 1% in early trading.

Today, Nomura’s Charlie McElligott picks up on this particular reversaion, and writes that while spot indexes this week have been banging around their largest gamma strikes at 4500 on the SPX ($6.6B next 6 months, $2.8B for Aug expiry, which would be a 43% dropoff), 370 on the QQQ ($1.7B next 6m, $1.1B for Aug, which would be a 66% dropoff) and 190 on the IWM ($808mm next 6m, $409mm for Aug, which would be a 46% dropoff), “the market continues to feel “fragile” here, and risks slipping further below these big strikes.”

Loading…

https://www.zerohedge.com/markets/0dte-volumes-blow-away-records-explosive-surge-short-gamma-sparks-extreme-market-fragility