- The Fed kept rates unchanged and provided more hawkish dot plots; signalled a further rate hike this year and fewer cuts next year.

- APAC stocks were pressured in the aftermath of the FOMC’s hawkish pause; US futures are also softer (ES -0.3%)

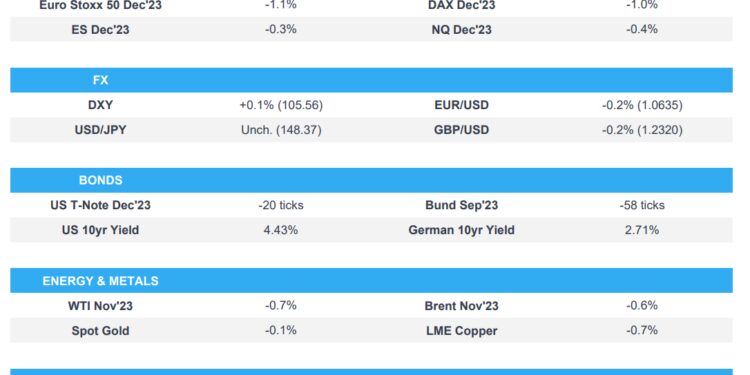

- European equity futures are indicative of a lower open with Euro Stoxx 50 future -1.0% after the cash market closed up 0.8% yesterday.

- DXY has held onto its post-FOMC gains, USD/JPY has advanced as high as 148.45, antipodeans lag peers.

- Brazil Central Bank cut the Selic rate by 50bps to 12.75%, as expected; anticipates further reductions of the same magnitude in the next meetings.

- Looking ahead, highlights include US IJC, Existing Home Sales & EZ Consumer Confidence (Flash), BoE, SNB, Riksbank, Norges Bank, CBRT & SARB Policy Announcements, ECB’s Lagarde, Schnabel & Riksbank’s Thedeen, Supply from Spain, France & US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks and bonds dipped in the aftermath of the FOMC meeting where the Fed unsurprisingly kept rates unchanged and provided more hawkish dot plots which signalled a further rate hike this year and fewer cuts next year with the 2024 dot plot at 5.1% which is 50bps higher than the June projection.

- SPX -0.94% at 4,402, NDX -1.46% at 14,970, DJI -0.22% at 34,440, RUT -0.9% at 1,810.

- Click here for a detailed summary.

FOMC

- FOMC kept the Federal Funds Rate target unchanged at 5.25-5.50%, as expected, in a unanimous vote. FOMC said economic activity is expanding at a ‘solid’ pace (prev. moderate) and job gains have ‘slowed’ (prev. ‘been robust’) but ‘remains strong’, while it stated that inflation remains elevated and the central bank remains ‘highly attentive’ to inflation risks.

- Dot Plot projections showed the Fed Funds Rate for 2023 is seen at 5.6% (prev. 5.6%), 2024 at 5.1% (prev. 4.6%), 2025 at 3.9% (prev. 3.4%), 2026 at 2.9% and in the longer run at 2.5% (prev. 2.5%).

- Fed Chair Powell said at the press conference that the current stance of policy is restrictive and they are committed to achieving and sustaining sufficiently restrictive policy to bring inflation down to 2% over time. Powell also noted that projections are not a plan and policy will adjust as appropriate, while they will continue to make decisions meeting by meeting and he repeated the Fed is in a position to proceed carefully Furthermore, they are mindful of uncertainties but are prepared to hike further if appropriate and will keep rates restrictive until the Fed is confident inflation is moving down to 2%.

- Fed Chair Powell said during the Q&A that the fact we decided to keep the policy rate where it is, does not mean that they have decided they have or have not reached a stance of policy they are seeking. Powell stated that they are fairly close to where they need to get and would not attribute huge importance to one more hike but also noted that stronger economic activity is the main reason for needing to do more with rates. Furthermore, when asked about neutral, he responded that you will only know when you get there and it may be that the neutral rate has risen and it is plausible that the neutral rate is higher than the longer run rate, while he also commented that forecasts are highly uncertain and growth has come in stronger than expected, requiring higher rates.

NOTABLE US HEADLINES

- US House Speaker McCarthy said the House will vote on a defence appropriations rule on Thursday and he has the support from two of the five Republicans who opposed the measure on Tuesday. McCarthy added that House Republicans are very close to an agreement on a short-term stopgap bill and are expected to begin moving forward on other appropriations bills after defence, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks were pressured in the aftermath of the FOMC’s hawkish pause.

- ASX 200 was lower with the top-weighted financial industry leading the broad declines.

- Nikkei 225 retreated below the 33,000 level as Japanese yields climbed to decade highs and with the BoJ kickstarting its 2-day policy meeting.

- Hang Seng and Shanghai Comp declined alongside the downbeat mood across regional peers, although the losses in the mainland were initially cushioned following the Chinese Cabinet’s pledge to speed up the development of the advanced manufacturing sector and amid resilience in developers after Guangzhou adjust purchase rules for several districts.

- US equity futures (ES -0.3%) continued to trickle lower amid residual selling in the aftermath of the FOMC.

- European equity futures are indicative of a lower open with Euro Stoxx 50 future -1.0% after the cash market closed up 0.8% yesterday.

FX

- DXY held on to its post-FOMC gains after benefitting from the Fed’s higher-for-longer signal on rates.

- EUR/USD was pressured by the firmer dollar and retreated further beneath the 1.0700 handle.

- GBP/USD remained subdued after the prior day’s softer-than-expected CPI data shifted money market pricing towards a coin-flip between a hike and a pause at today’s BoE meeting.

- USD/JPY took a breather after it reclaimed the 148.00 handle in the aftermath of the Fed meeting which spurred another bout of the familiar currency jawboning from Chief Cabinet Secretary Matsuno.

- Antipodeans were dragged lower alongside the negative sentiment and downside in commodity prices, while better-than-expected New Zealand GDP failed to inspire the domestic currency.

- PBoC set USD/CNY mid-point at 7.1730 vs exp. 7.3052 (prev. 7.1732)

- Brazil Central Bank cut the Selic rate by 50bps to 12.75%, as expected, while it stated that committee members unanimously anticipate further reductions of the same magnitude in the next meetings and the pace of rate cuts is appropriate to keep monetary policy contractionary for the process of disinflation. BCB also stated that the total magnitude of the easing cycle will depend on inflation dynamics, expectations and projections, output gap and balance of risks.

FIXED INCOME

- 10yr UST futures continued to slump as yields extended higher across the curve including the US 2-year yield which climbed to a fresh 17-year high in the aftermath of the Fed’s hawkish pause.

- Bund futures prodded yesterday’s lows and retreated further away from resistance near 130.00.

- 10yr JGB futures were dragged lower amid spillover selling and after the 10yr JGB yield touched its highest in a decade, while the latest enhanced-liquidity auction in the long-end saw weaker demand.

COMMODITIES

- Crude futures remained on the back foot amid the negative risk tone and firmer dollar.

- Saudi Crown Prince MBS responded that output reductions are purely based on supply and demand to the market when asked about criticism that oil output cuts help Russia.

- Iran’s oil exports have increased as the US has backed away from some sanctions enforcement, according to WSJ.

- Australian industrial arbitrator said Chevron (CVX) and unions are on the precipice of achieving the first enterprise agreements for LNG facilities and discussions have resulted in widespread agreement on the majority of provisions of proposals. The arbitrator made recommendations on pay and working conditions for Chevron and unions to consider but noted that a failure to settle all outstanding issues would result in the agreed provisions simply evaporating, while parties are required to advise the commission of their acceptance or rejection of recommendations by 09:00 Sydney time on Friday.

- UK PM Sunak said they will not ban new oil and gas in the North Sea and will bring forward reforms for energy infrastructure.

- Natural Gas Pipeline Co. declared a force majeure on the M&M line near compressor station 158 located in Dewey County, Oklahoma.

- Spot gold was lacklustre after recent selling and as the dollar held on to Fed-induced gains.

- Copper futures remained pressured alongside the negative mood across risk assets.

- Russia is mulling an additional tax on exports for some commodities including metals, according to sources cited by Reuters.

CRYPTO

- Bitcoin traded marginally lower and briefly declined beneath the USD 27,000 level.

NOTABLE ASIA-PAC HEADLINES

- HKMA maintained its rate unchanged at 5.75%, as expected.

- Japanese PM Kishida said he will instruct people to pull together the pillars of an economic package early next week, while they will include measures to counter inflation and social measures to counter declining population, according to Reuters.

DATA RECAP

- New Zealand GDP QQ (Q2) 0.9% vs. Exp. 0.5% (Prev. -0.1%)

- New Zealand GDP YY (Q2) 1.8% vs. Exp. 1.2% (Prev. 2.2%)

GEOPOLITICS

- Russian Foreign Ministry said NATO drills near Russian borders are increasingly provocative and aggressive in nature, as well increase risks of incidents, according to RIA.

- Saudi Arabia said solving the Palestinian issue is critical to a deal with Israel, according to FT. In relevant news, Saudi Crown Prince MBS said he is prepared to work with whoever is leading Israel if there is a breakthrough in negotiations for normalisation with Israel, while he had also commented that Saudis will get a nuclear weapon if Iran does first, according to AFP and Fox News.

- Iranian President Raisi said Iran has no problem with IAEA inspections of its nuclear sites.

- Qatar held separate bilateral meetings with the US and Iran this week, touching on nuclear and drone issues, according to sources cited by Reuters.

- Kuwait’s PM said the Iraqi ruling on regulating navigation in Khor Abdullah Waterway includes historical fallacies and Iraq needs to take concrete, decisive and urgent measures to address the ruling, according to Reuters.

EU/UK

NOTABLE HEADLINES

- ECB’s Wunsch said they may have reached the peak, but high uncertainty has made it very unclear whether the last ECB rate hike would be the final one, according to comments from last Thursday cited by Econostream.

Loading…

https://www.zerohedge.com/markets/hawkish-fomc-dot-plots-ahead-central-bank-bonanza-newsquawk-europe-market-open